Most people know that when the dollar weakens against other currencies, the price of gold tends to increase. This is simple economics - gold is priced in dollars and so when the dollar is worth less you get more bang for your buck, which in turn drives up the price of gold due to the increased demand.

Gold has been range-bound since early November, trading between $1700 and $1738. Since the end of last week gold has built a solid base between $1720 and $1730, but couldn't find the momentum to carry beyond the strong resistance around $1734-$1738. This price action resulted in an upwards triangle pattern and, in an upside break, when the price breaks out of the triangle it tends to go with some gusto.

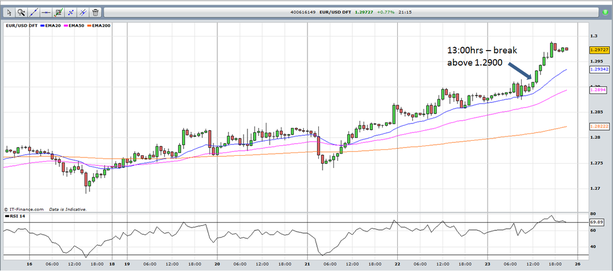

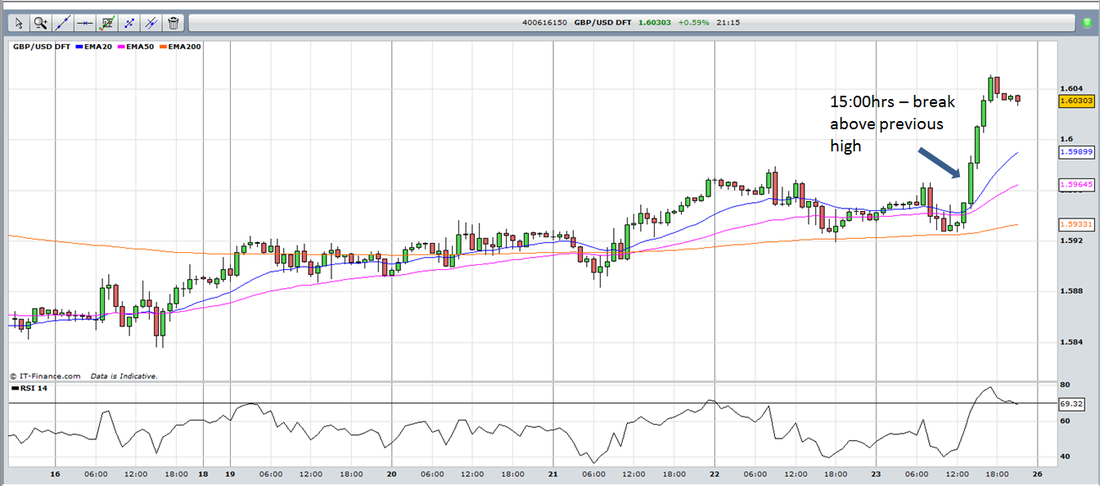

The two charts below show both the Euro and Sterling putting in large gains against the Dollar shortly after lunch yesterday.

As gold breached these key areas of resistance, short stop losses and long buy orders would have been triggered, adding even more momentum to the upwards move.

Early next week, the focus will be back on Greece as Eurozone leaders attempt to arrive at new debt targets for the stricken country before agreeing to release the next wave of bailout funds. An agreement is likely to underpin the Euro and so add more of a boost to gold prices.

Later in the week eyes will turn to speeches by Fed members where traders will attempt to predict the likely outcomes of the next FOMC meeting on December 11th & 12th. This will be the first meeting since the US Presidential elections and investors will be watching the speeches next week to try to gain some insight into the Fed's plans as the "Operation Twist" program comes to an end in December.

We foresee a short period of consolidation for gold next week before a continuation of the rise towards $1800. There is resistance at $1785 and then again at the previous 2012 high of $1796.

On the downside, there is solid support $1720-$1715 and again at $1700.