Briefly: In our opinion no speculative positions are currently justified from the risk/reward perspective.

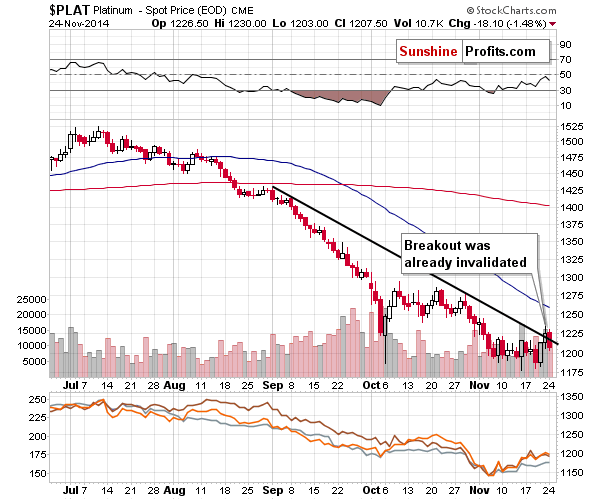

Yesterday was a day when the precious metals market took a breather, but it’s not true that nothing changed at all. Friday’s breakout in platinum was invalidated. Is this a “short again” signal?

In short, not really, because this signal – even though it’s bearish – is not enough to make the situation very bearish on its own.

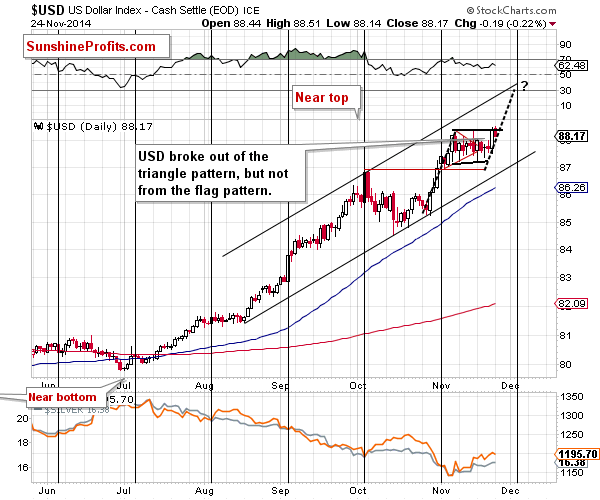

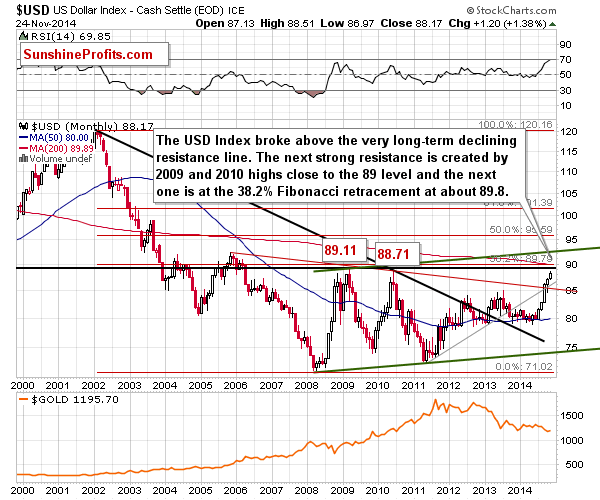

As usual, let’s start today’s analysis with the USD Index (charts courtesy of http://stockcharts.com).

The USD Index moved visibly higher on Friday, breaking out of the triangle pattern. The implications are bullish but not strongly bullish, as the pattern started to resemble more of a flag than a triangle. Since the flag pattern was not broken, many traders probably thought that the situation hadn’t changed. This could explain the lack of response in the precious metals market. If we saw a strong breakout and metals didn’t react, then it would definitely be a sign of strength, but at this time, it could be the case that the market participants are still not viewing the dollar’s move as a something real.

(…)

The downside is limited in case of a breakdown, and the upside is visibly higher in case of a breakout. If we see a move similar to the one that preceded the recent consolidation, then we could see a move close to the 89 level that would materialize in the first part of December. This scenario seems quite likely also given the resistance line that would be reached (it would simply “fit”) and the cyclical turning point – we are likely to see at least a local top close to it.

We could see a small move lower before the rally starts, though. This means that the above doesn’t invalidate our previous outlook and price targets for the precious metals sector.

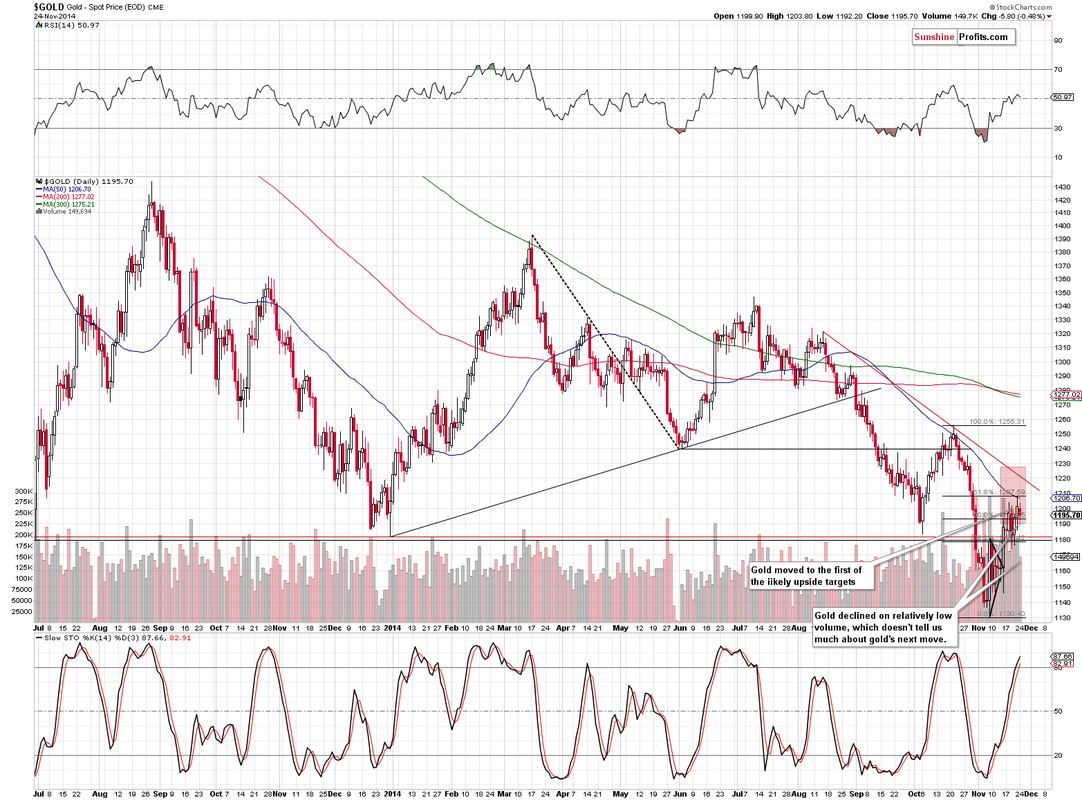

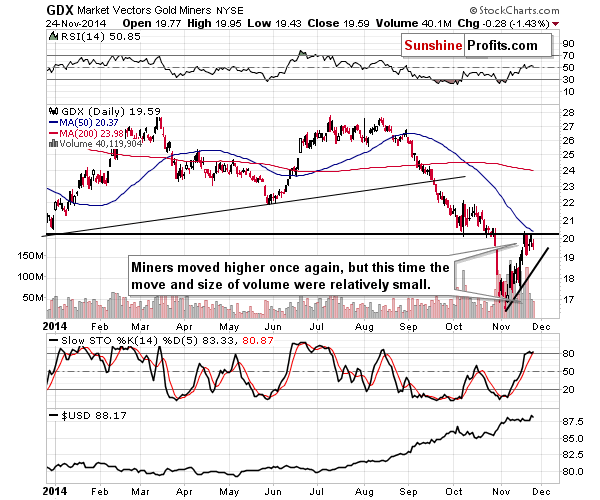

As basically nothing changed in the silver market (and what we wrote yesterday remains up-to-date) and changes are very similar in gold and mining stocks, we will comment on the last 2 markets simultaneously.

Consequently, our yesterday’s comments on gold remain up-to-date:

(…) we can see that gold moved to the lower of our upside target levels. This level is created by the 61.8% Fibonacci retracement level and the 50-day moving average. The last time gold touched its 50-day MA, it was one day ahead of the top.

The implications of the above are bearish, but at this time we can’t rule out another $20 or so move higher, which would take gold to the declining resistance line.

Since gold moved higher along with the USD, we could very well see a further upswing (if the USD declines at least a bit), but if the USD breaks above the flag pattern, then gold will likely decline right away.

What about platinum?