Mining stocks is the general name for the stocks of companies extracting metals. The term is pretty self-explanatory, companies that qualify to this category mine metals, not only precious metals but also ores like copper. From the perspective of a precious metals investor, the most interesting mining stocks are those linked to gold, silver, platinum and, possibly to a lesser extent, palladium. In these considerations we’ll apply the term “mining stocks” in this restricted form, and only to senior mining stocks.

A precious metals investor might be interested in mining stocks for a variety of reasons. First of all, mining stocks are readily available in the sense that you can buy them very much like you would buy any other kind of stock via your broker account. So, buying them is easy and the commissions on these transactions are not very high. Secondly, it’s not only easy to buy mining stocks, it’s also relatively easy to sell them, meaning that there usually is a wide range of possible buyers and sellers so you can close out your positions very quickly. This is what we would call “liquidity.” Thirdly, unlike buying physical gold, buying mining stocks doesn’t incur specific types of storage costs which might be quite significant. You only pay stock commissions and this means that holding mining stocks is generally cheaper than holding gold in designated vaults or via a custodian. If you’re interested in different ways to gain exposure to the precious metals market, you can delve right into our How to Buy section. There’s a whole article there on how to buy gold and silver mining stocks.

The above are the basic advantages of mining stocks as a trading or investment vehicle but there are also finer points here. Miners might offer leverage but not necessarily in the traditional sense of operating on more debt. The leverage here would be possibility to multiply gold’s returns. In simple terms, on average, it is possible that if gold moves 1% up, some miners will move more than 1% up, thereby offering a multiplication effect. In this setting, an investor looking for exposure to the gold market could try to magnify their returns by including selected gold stocks in their portfolio. The catch here is which stocks to choose. Some will have leverage over 1, they will magnify gold’s returns (but also losses), some will have leverage below 1, diminishing returns (but also losses). Moreover, this is not a stable situation. Stocks with most leverage can “lose” it over time and, conversely, stocks with low leverage might “gain” it over time. In other words, if we were to rank gold stocks based on their leverage, they would trade places over time.

From that stems the second subtle point. If the leverage of gold miners at any moment is negative, this would mean that a move up in gold could correspond to the stock moving down. While this might not look very attractive at first, think about times when gold plunges. In such periods of negative returns on gold, stocks with negative leverage could actually go up. This would be far from certain, but it seems that some miners can appreciate even in prolonged periods of falling gold prices.

Sounds interesting? Leverage is not everything that matters in our approach, and we give more specific examples in just a few paragraphs.

In discussing our top gold stocks picks for January 2015, we have to recognize that there is really no such thing as a “top gold stock” just as there is no such thing as the “best car in the world.” It all depends on what you need. If you’re into off-road experience, you might go in for a shiny 4x4 vehicle. But you might be more concerned with pure horsepower, in which case you might end up with a sports car. There are various possibilities here as different things might be of importance to you. In a way, choosing a best gold stock is the same. So we’ll explicitly write what our picks are based on.

For ranking gold stocks, we’re going to use the Gold Stock Ranking, an in-house tool developed at Sunshine Profits, and subsequently made available for customers. This tool ranks gold stocks based on a number of factors, among them leverage as defined previously. For all our calculations, we assume that the person interested in gold stocks has low risk tolerance. This means that the person likes their gold stocks to track gold and would be inclined to sell them if they underperformed gold. Before we proceed, we would like to stress that our tools are not providing “investment advice” – they are available to help you make decisions on your own, but you will also need to take other factors into account while making investment decisions (tax implications would be one example).

The distinction we’ll make now is based on how long the position is intended to be held. If the holding period is shorter than 6 months, we’ll consider this a short-term position. If the time horizon is longer, this will be called a long-term position. This might be different than you define the short and the long term but the most important part here is that the short-term time frame is more speculative and the long-term horizon is more of a fundamental investment.

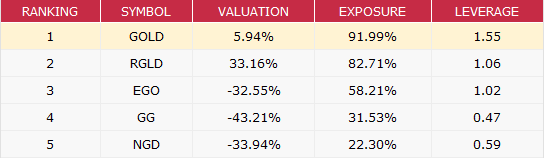

Let’s start off with the case when the approach is a short-term one. A short look at the Gold Stock Ranking (as of Jan. 7, 2015):

The second column (“Symbol”) is the symbol (ticker) of a given company you will see on stock exchanges.

The third column (“Valuation”) shows you the valuation of the company relative to its “usual” value relative to gold (calculated according to our proprietary methodology). Positive values here mean that the stock might be overvalued relative to gold. By the same token, negative values might suggest that the company is undervalued relative to the yellow metal.

The forth column (“Exposure”) shows you how well the company performs as a proxy for gold. It is based on the R-squared (statistical measure) for the gold stock and gold and can be interpreted as how well the price of the gold stock might be explained by the price of gold. 100% is the maximum value here, 0% the minimum. Generally, values over 50% might be considered as relatively significant.

The fifth column (“Leverage”) should be familiar by now – this is the leverage relative to gold, as explained earlier in this article. In general, the higher the value in this column, the greater the leverage – the more the moves of the price of the gold stock have magnified the moves of the price of gold. A value above 1 means that the stock has, on average, outperformed gold, a value below 1 means that the stock has, on average, underperformed the yellow metal. A negative value shows that the stock has, on average, traded in the opposite direction than gold.

Additionally, the interactive version of our investment tool gives you more info – for instance, moving the mouse cursor over the value in the first column will flash a short info on whether the stock might, on balance, be considered a valuable addition to a precious metals portfolio.

Moving on to the specific values seen in the table, we see that Randgold Resources (GOLD) leads the pack with exposure at over 90% and leverage above 1.5. These seem like favorable values – the Randgold stock looks like it moves in the same direction as the price of gold and it also offers more bang for the buck than gold does, on average and based on past data. This is supported by the information the Gold Stock Ranking gives you: “Including GOLD [ticker for Randgold Resources] in your portfolio appears to be a good idea.” The valuation doesn’t seem to be too big a concern – Randgold might be almost 6% overvalued according to our methodology but this is not an extreme position.

The second spot is taken by Royal Gold (RGLD), with exposure over 80% and leverage slightly over 1. These are generally speaking, values less favorable than what we’ve just observed for Randgold Resources, but still relatively favorable ones. The Gold Stock Ranking summarizes the situation by giving you info that “Including RGLD in your portfolio appears to be a good idea.” One concern here is that Royal Gold seems to be overvalued relative to gold. The tool also gives you info that you might consider switching to other stocks close in the ranking but less overvalued (or even undervalued) around price bottoms. This could mean that Randgold could be a better choice during such times.

Eldorado Gold (EGO) comes in third but with values visibly worse than the two previous stocks. Exposure is still above 50% and leverage above 1, but the Gold Stock Ranking distils this data into the suggestion that “Purchasing EGO might be useful for diversification purposes, but it seems that it’s not providing much advantage over investing in gold itself.” So, Eldorado is not exactly a terrible gold stock by our criteria but not a terrific one either. One positive thing about Eldorado is that it seems undervalued relative to gold.

The remaining two stocks have visibly lower exposure and leverage values, which might suggest that they are not particularly interesting for an investor seeking exposure to gold with leverage as we have defined it. In fact, the Gold Stock Ranking suggests that “Purchasing [them] is not advised.”

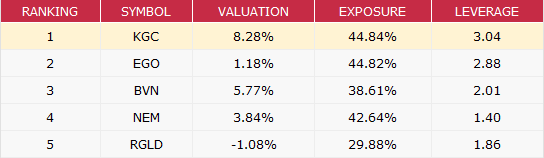

Now, let’s change the objective a bit and consider gold stocks that the tool suggests for a long-term position (as of Jan. 7, 2015). By that, we mean a position intended to be held for more than 6 months.

The second stock in this rating is Eldorado Gold (EGO) which we have already seen in the short-term ranking. Eldorado Gold has similar characteristics to Kinross Gold here, with marginally lower exposure around 45% and slightly lower leverage under 3 but it might be less overvalued. The Gold Stock Ranking suggests: “Including EGO in your portfolio might be a good idea.” It seems that this might particularly be the case around price bottoms where Eldorado Gold might be considered instead (or together with) Kinross Gold. Please note that it seems, based on the two rankings (short-term and long-term) that Eldorado might be a better vehicle for a long-term position than for a short-term one.

Compañia de Minas Buenaventura (BVN) lands third with lower exposure and leverage values than the two previous stocks. Our ranking suggests: “Purchasing BVN might be useful for diversification purposes, but it seems that it’s not providing much advantage over investing in gold itself.” If you want to further diversify your portfolio (beyond Kinross and Eldorado), Buenaventura might be the stock to look at.

The fourth place is occupied by Newmont Mining (NEM), which has exposure in the range of that seen for the two first stocks but visibly lower leverage and is slightly more overvalued than Eldorado. The tool suggests: "Purchasing NEM is not strongly discouraged, but it seems that you might want to choose other stocks or invest in gold itself.”

The same goes for Royal Gold (RGLD), which has more favorable leverage and is the only undervalued stock in this top 5 (albeit only marginally) but also does seem to have less favorable exposure to gold. Also note that Royal Gold seems to be a more favorable vehicle for short-term positions (in our short-term ranking) than for long-term ones.

Now, a more general thought. Based on our two rankings, it looks like in the short term the top gold stocks track gold relatively well but offer possibly limited leverage. Also, there are only two stocks suggested by the tool as picks. For the long term, there are only two suggested picks but no stock is discouraged as an investment. This might mean that currently short-term positions in gold stocks might track gold but won’t offer significant return multiplication. In the longer term, you can possibly expect less consistent tracking of the price of gold but multiplied returns (which might also mean multiplied losses).

In this article, we have discussed the top 5 gold stocks for January according to our Gold Stock Ranking, delving into both short- and long-term positions. A more comprehensive ranking of gold miners can be found on the Gold Stock Ranking web page. Using this tool you can interactively adjust the ranking to the basic characteristics of your investment approach and get onscreen hints right away. Interested not only in gold stocks but also in silver miners? Check out our Silver Stock Ranking, which is a similar tool, only for silver stocks.

Please note that the positions of gold stocks and silver stocks in the rankings change – while the changes are not necessarily visible on a day-to-day basis a week or month can change a lot. In order not to stick with stocks that stop outperforming, we think that rebalancing one’s holdings is appropriate. Based on our research best results were achieved by rebalancing gold stocks every 50 days and by rebalancing silver stocks every 20 days, when using the Golden Stock Ranking and the Silver Stock Ranking. This strategy has greatly outperformed the simple buy and gold approach.

Finally, we can’t stress the importance of proper portfolio structuring so go and visit our page on the gold and silver portfolio, to learn why including various kinds of assets (not only gold and silver) in a precious metals portfolio might be the preferred way to go.

Regards,

Mike McAra

Bitcoin Trading Strategist

Sunshine Profits: Gold & Silver, Forex, Bitcoin, Crude Oil & Stocks

Sunshine Profits: Gold & Silver Trading Alerts

Stay updated: sign up for our free mailing list today

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.