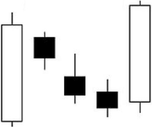

| We are predominantly technical traders, using a combination of Fibonacci Retracements, Elliot Wave Analysis and Japanese Candlesticks to help us predict where the gold price is moving to next. In this article we look at the main Candlestick patterns we use to spot price reversals and confirmations. First the basics: |

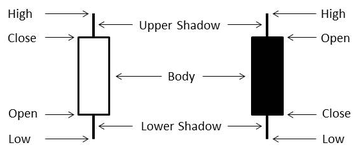

The body of the candlestick is the open and the close of the trading session (be that daily, hourly, 15 minutes, 1 minute, etc.). The high and the low of the session create the upper and lower shadows of the main candle body.

Reversal Candlesticks & Patterns

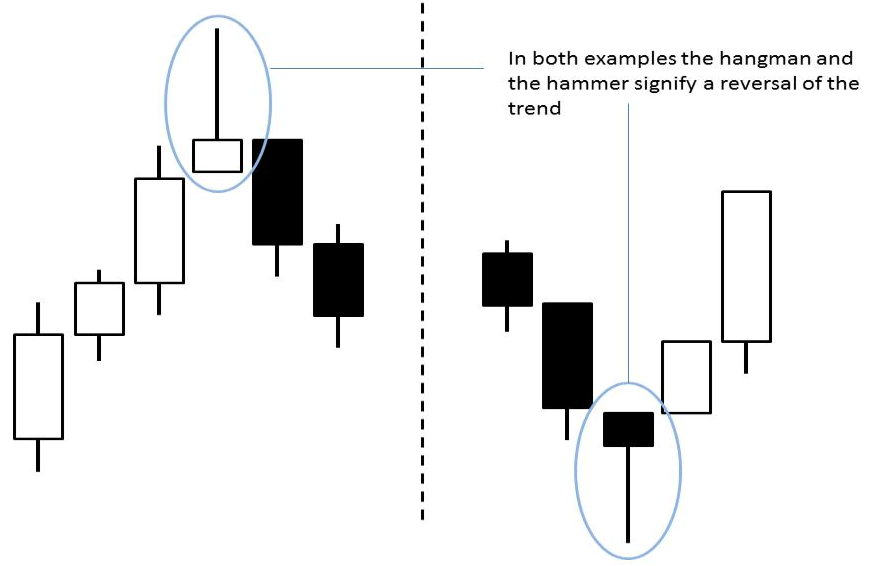

The Hammer & Hangman The hangman and hammer consists of a small body (of either colour) with a very long lower or upper shadow. This pattern is typically found at the top or bottoms of trends. When the pattern occurs at the top of an up-trend it is called a hangman, when it is found at the bottom of a down trend it is called a hammer. |

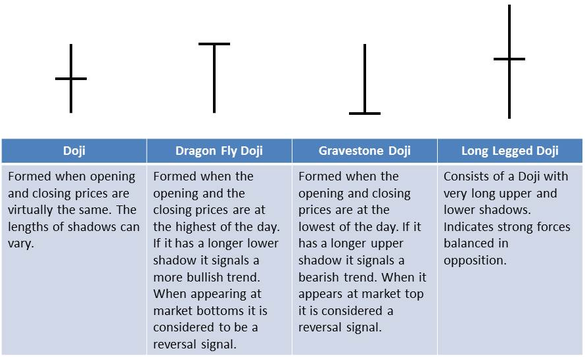

Doji's

Sansen / Three Rivers / Three River Evening Star

The second session candle can be black or white. It is small in form (hence the star) and it gaps above the close (i.e. it opens higher than the previous close) of the first candle.

This is considered a strong reversal signal when it appears at the top of an up-trend

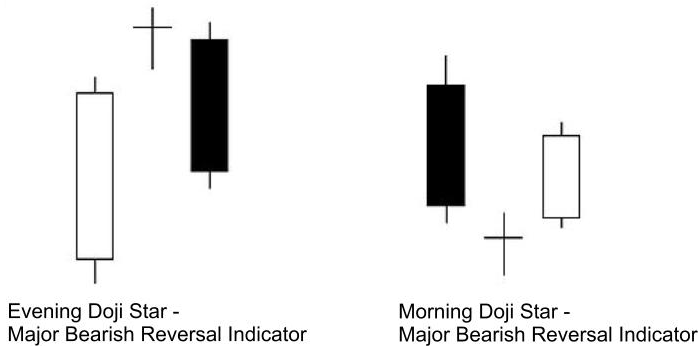

Evening / Morning Doji Stars

| The same principles apply as both the Evening and Morning Stars above (i.e. second candle must gap up/ down and the third candle must close within the body of the first). Doji Stars are an even greater signal of a reversal given that the second candle is replaced with a Doji which, in itself, is a strong indicator of a reversal. |

Confirmation / Continuation Patterns

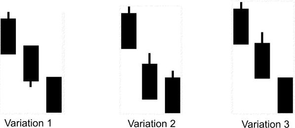

Bearish Sanpei or Three Crows

It doesn’t matter too much – so long as the candlesticks are of similar size and continues to make lower lows it indicates that there is a continuation of the trend.

Bullish Sanpei or Three Soldiers

Each session opening at the close of its predecessor and the candles being long in length, indicates a strong up-trend.

If the sanpei is started by a small white candle, followed by a long white candle and then a small bodied white candle (as per Variation 3 above), this indicates uncertainty and a possible reversal.

When any variation of this occurs following a bottom, it is confirmation that a reversal is in.

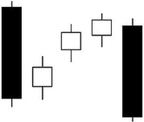

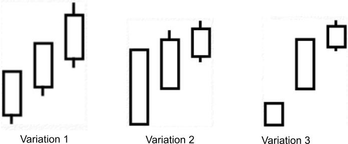

Sanpo's or Three Methods

Bearish Sanpo The three white candle bodies are contained within the range of first black body. This is considered as a bearish continuation pattern. | Bullish Sanpo If the three black candle bodies are contained within the range of the first white body it is considered an indication of a bullish continuation pattern. |

We hope you have found this article useful! Read more from our "How to Trade Online" series here...