Our trailing stop was triggered at 1327.2 so we managed to bag an extra 20 points by using the trailing stop on this occasion. So, from set up to exit let’s take a look at today’s trade.

Our automated trading system triggered in the early hours at 03:08 GKFX time, which is 2hrs ahead of the UK. Automation has so many benefits for us – it takes the emotion out of the decision making and allows us to trade around the clock, so our overseas subscribers in different time-zones also get trade alerts during their trading day.

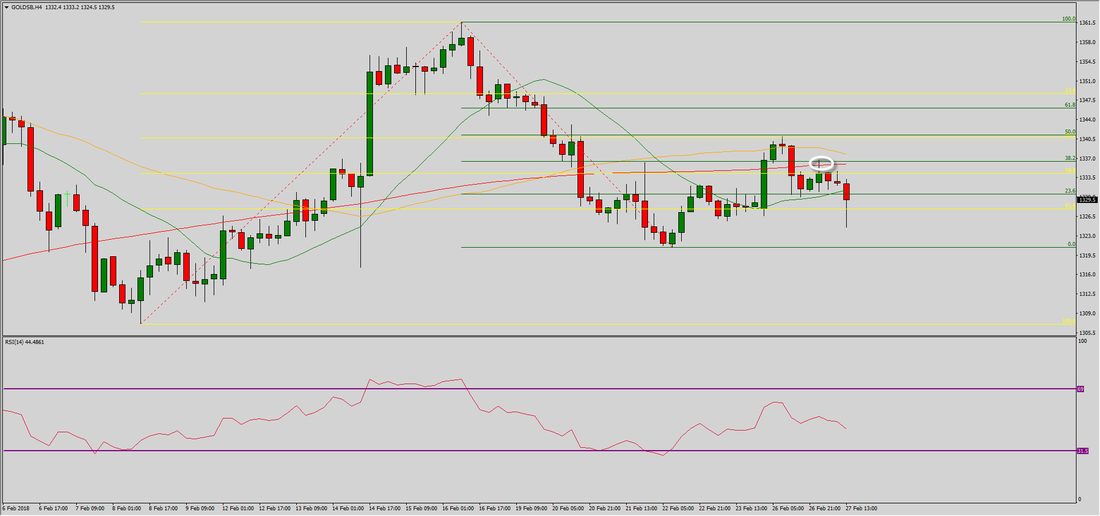

Let’s first look at the set up. The chart below is a zoomed-in 4H chart – notice where the 200-bar Moving Average is (the red line) at the point we opened (circled in white)…right around 1336. We’ve also got the 38.2 green fib level at 1336, so a good place to expect a reversal. Also take note of where the 50-bar Moving Average is (the orange line), just shy of 1339 – this is what was used for our stop.

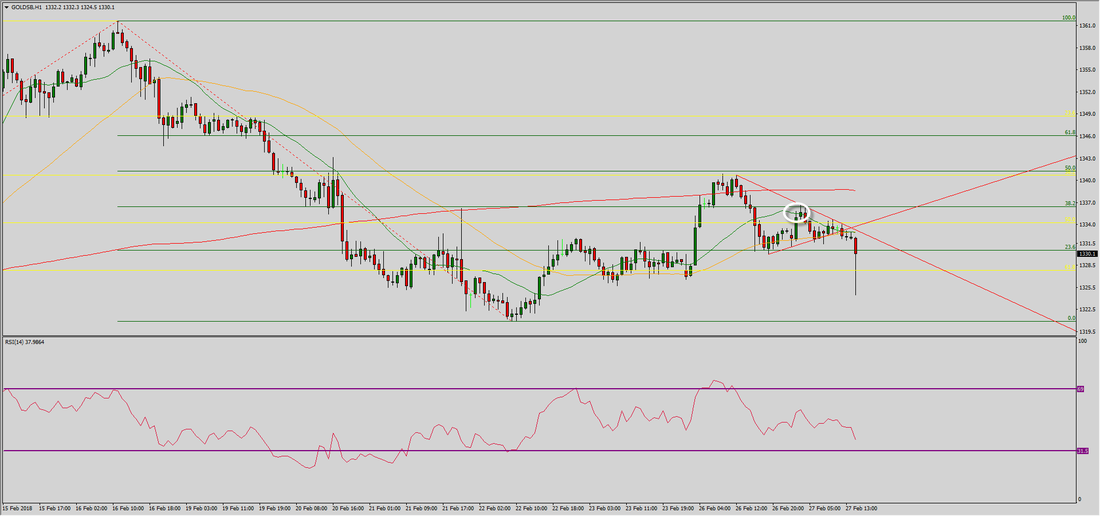

As the morning unfolded we had a rising head-and-shoulders pattern form on the 15m, along with the triangle pattern shown in the chart below. When price broke out of the triangle we put you subscribers on alert that we were changing strategy – initially bringing our stop to below our entry and pushing our target out to give us some time to react if price fell sharply as we wanted to switch to a trailing stop at 1330 when the head and shoulders patter broke.