INTERMEDIATE TERM TREND: BEARISH

SHORT TERM TREND: NEUTRAL/BEARISH

VERY SHORT TERM TREND: BEARISH

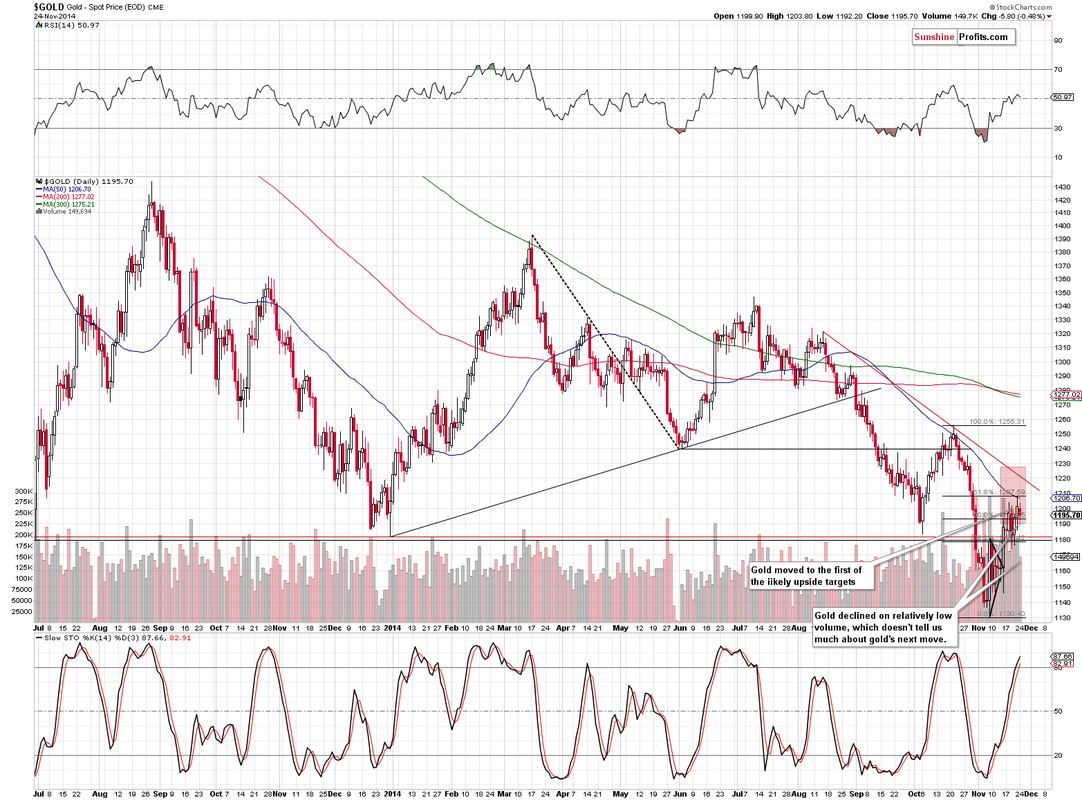

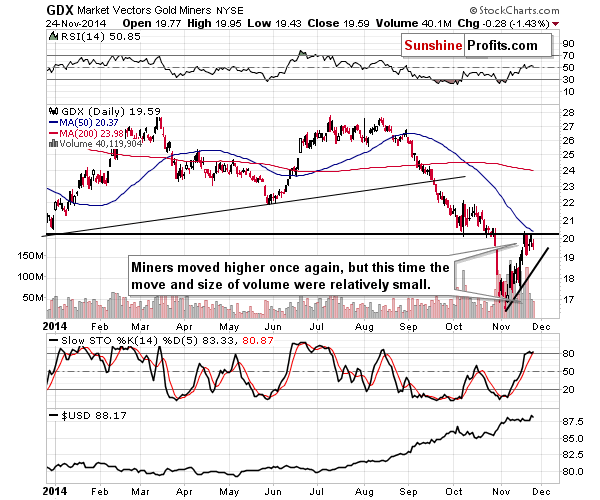

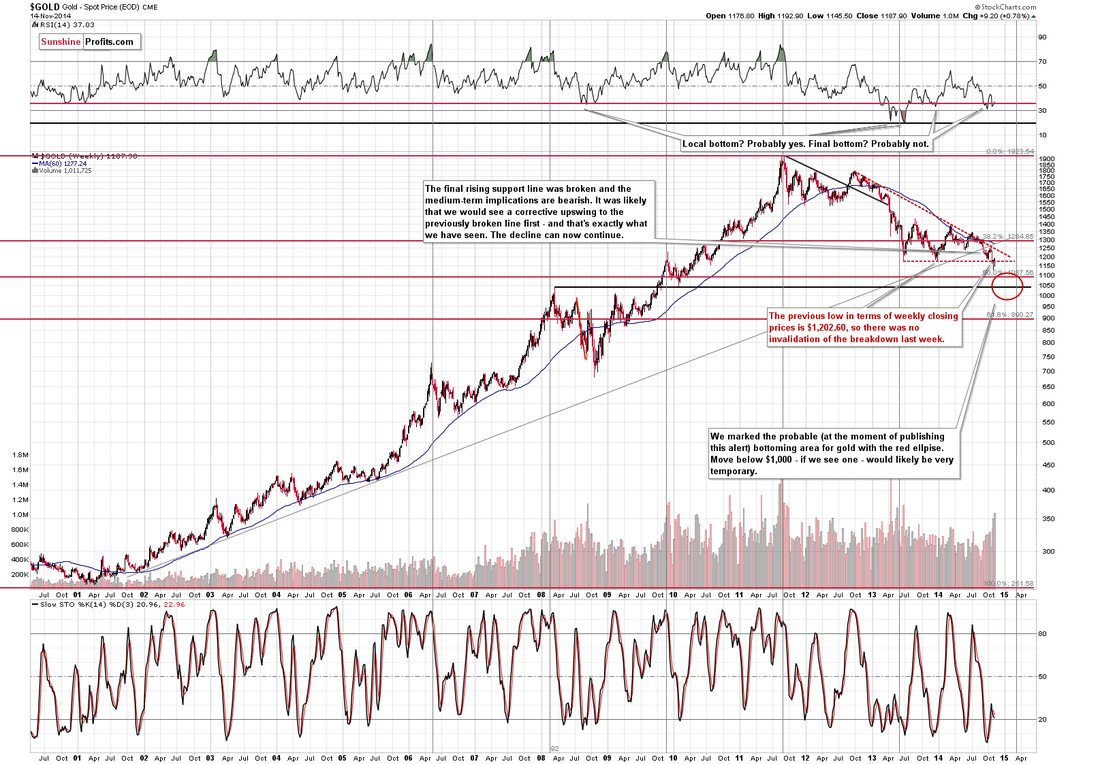

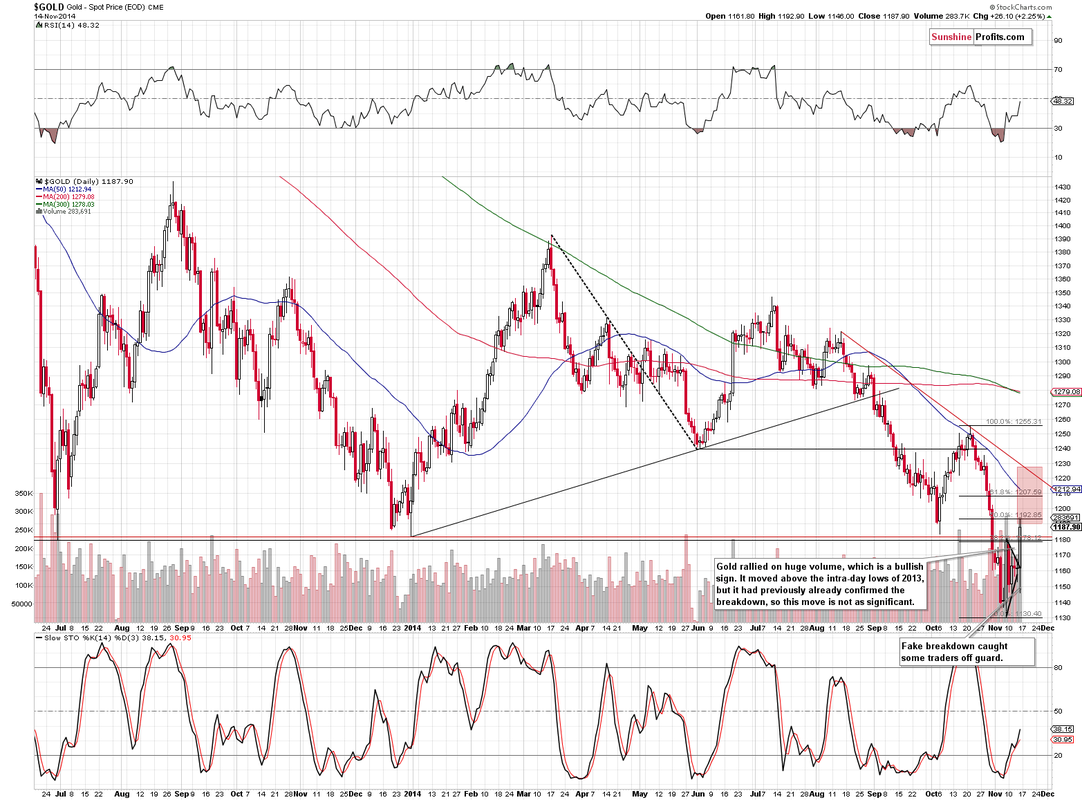

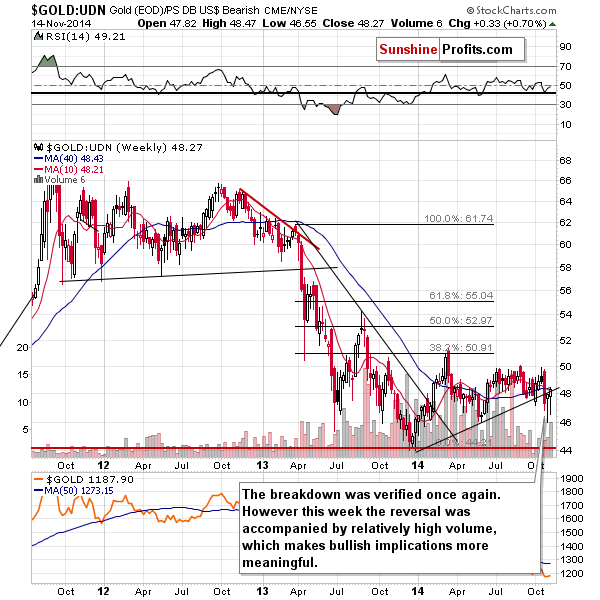

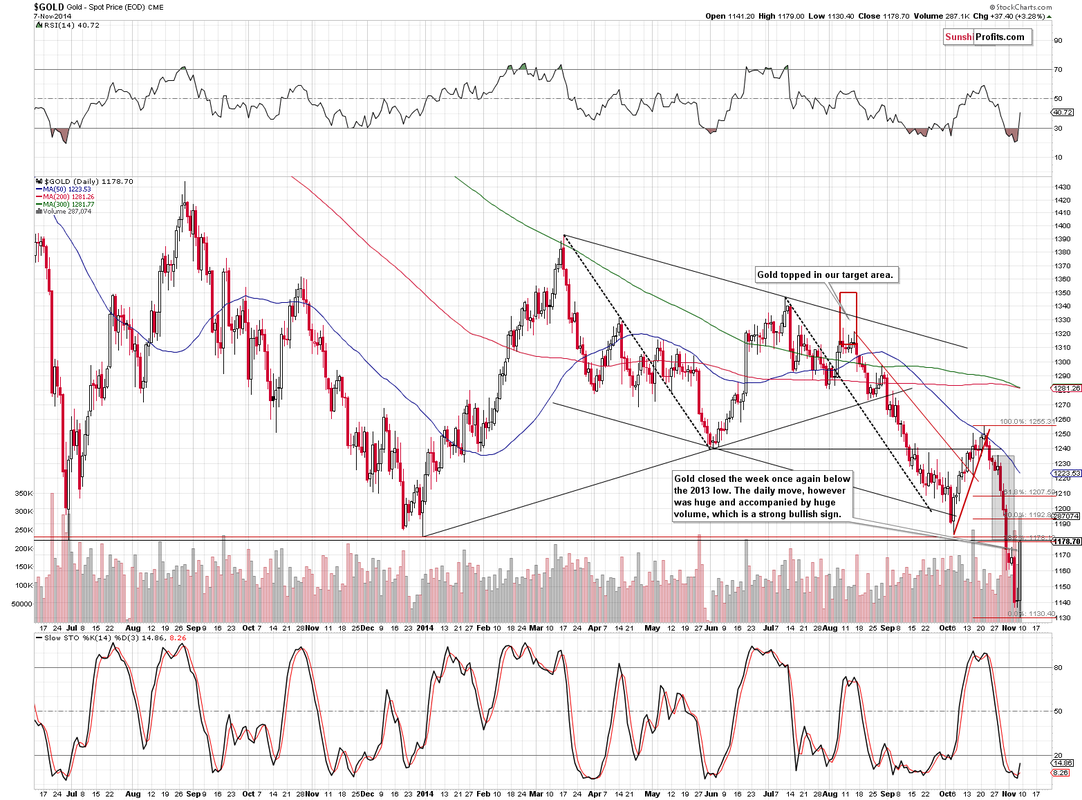

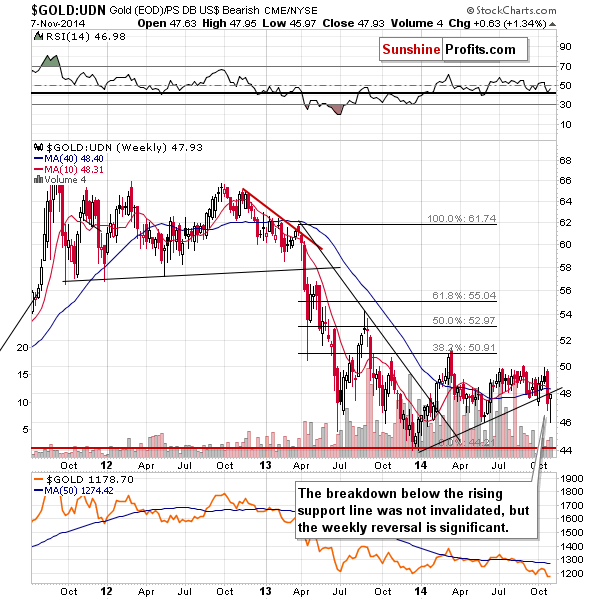

Although the trading volumes have been light due to the Thanksgiving holiday in the US, gold broke below the lower boundary of the bearish rising wedge as expected and is now declining after finding strong resistance at the 61.8% retracement level and the 50 DMA last week.

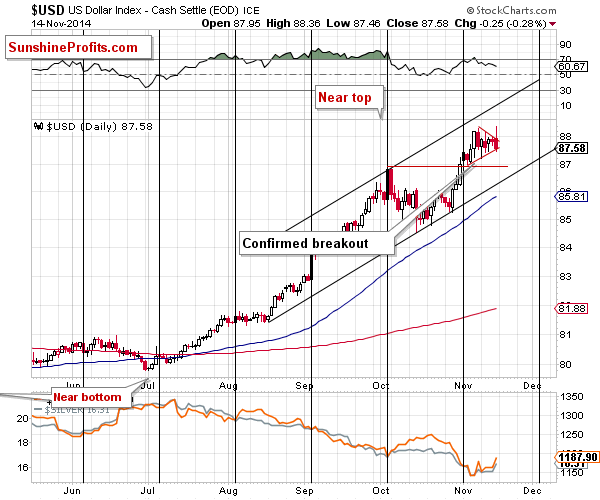

The catalyst for the decline has been the cratering oil price as a result of OPEC maintaining their production levels, as a "price war" with US shale producers takes hold. With Crude Oil now trading below $70 a barrel for the first time in 4 years, inflation concerns have completely disappeared and gold will inevitably suffer.

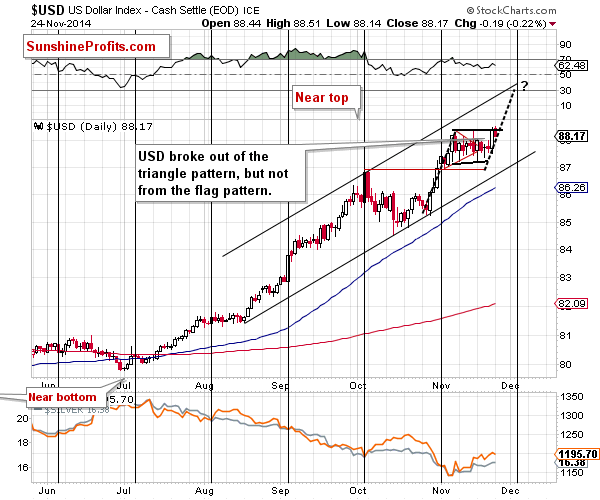

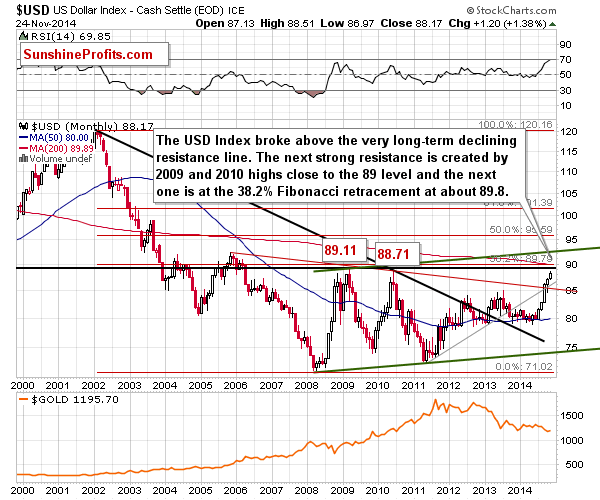

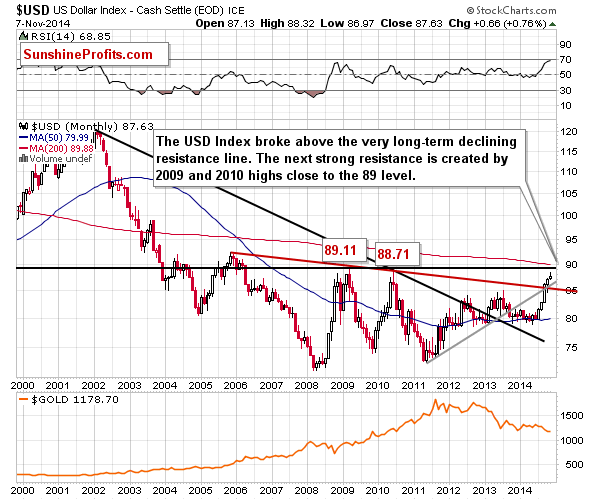

Equities remain the story, with a strong dollar weighing in to undermine gold's appeal - we maintain our stance that there is little reason to hold gold at the moment, other than a core insurance holding of say 10% of a balanced portfolio.

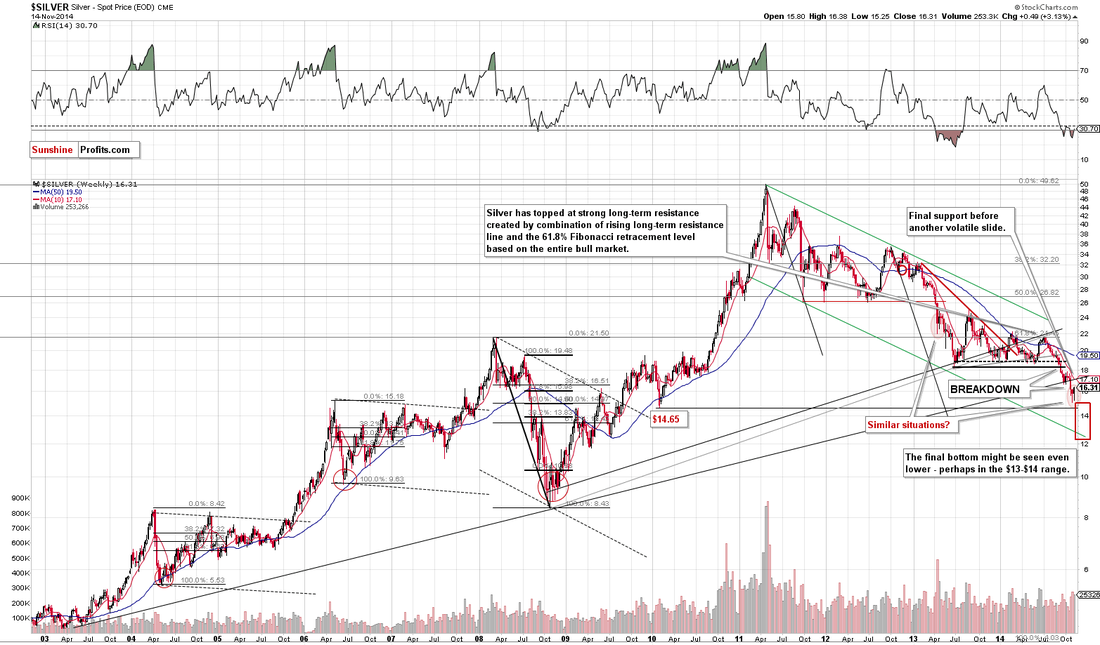

Support can be found at 1180-1183, 1175-1178, 1154, 1145-1147, 1131, 1124, 1100, 1085, 1045 and 1000 . The break of 1180 has serious bearish implications for gold and suggests a decline to 1000-1050 in the short term, unless gold can hold above this level and build a base to move higher.

Resistance can be found at 1188, 1200, 1205, 1208, 1222, 1225, 1235, 1250, 1255, 1263, 1271-1273, 1290-1292, 1300-1302, 1310-1312, 1322-1325, 1333-1335 and 1345. A second failure to break through the key 65 week MA confirms that the intermediate down trend is intact and the break of 1180 suggests the bears are in full control.

Today's video for subscribers looks at the recent trading in more detail and our strategy for our current short position.