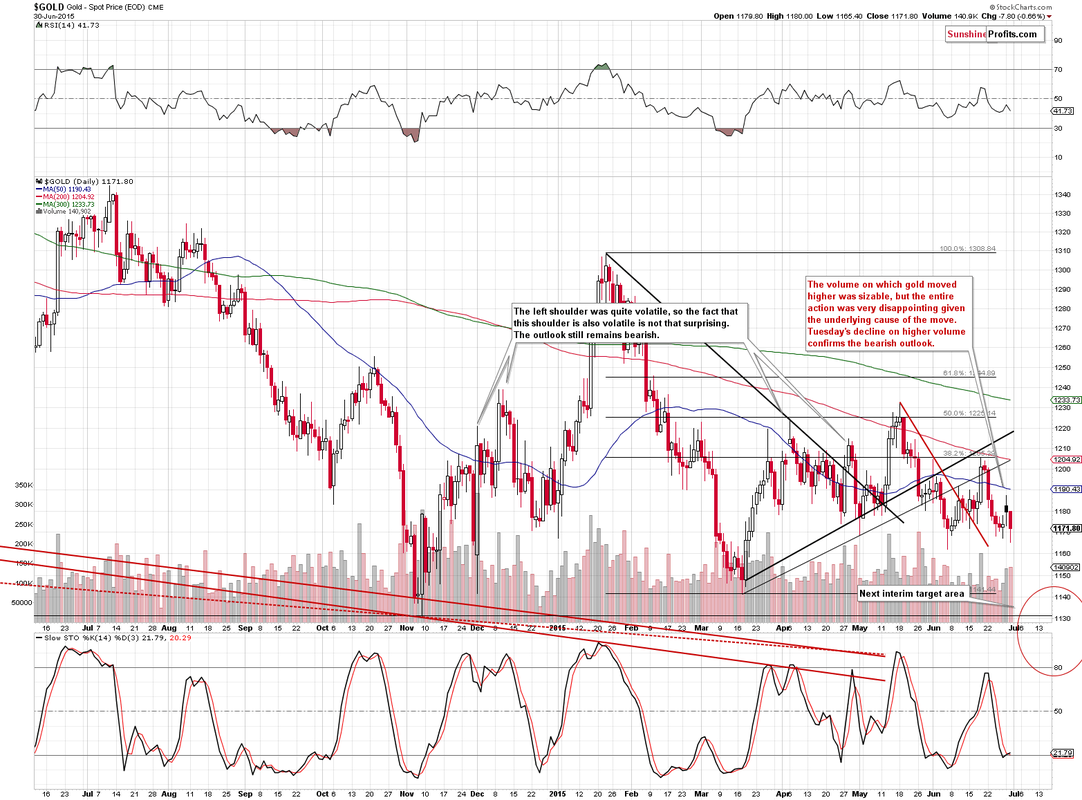

INTERMEDIATE TERM TREND BEARISH

SHORT TERM TREND BEARISH

VERY SHORT TERM TREND NEUTRAL

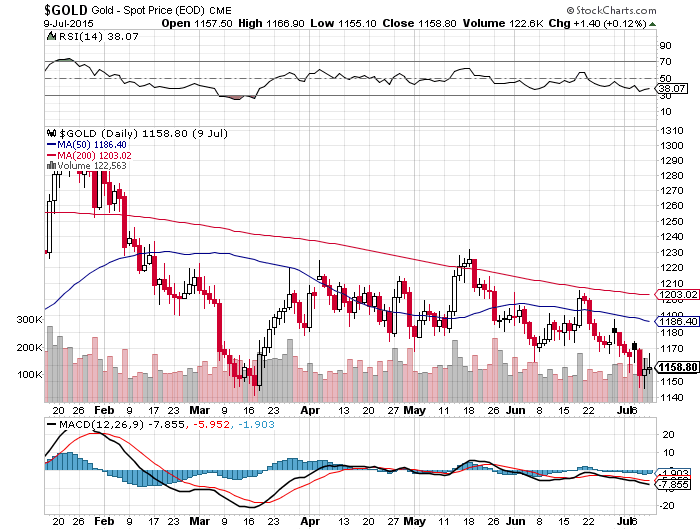

After crashing through the key 1130 level early on Monday morning last week, gold made a lower low at 1074 on Friday before rebounding sharply. The price briefly broke above 1100 and it is clear that gold is attempting to form a local bottom.

We expect a retest of 1130-1140 before the down trend resumes, with our next target 1050, then 1000 below that. The 20 DMA is currently at 1135 and dropping fast – this will be the first resistance test for the bulls on any rally attempt. The RSI remains heavily oversold on the daily chart, though the recent bounce has seen the RSI on the shorter timeframes rise well clear of the oversold zone.

Equities remain weak as the uncertainties in Europe and the Chinese stock market weigh on prices, whilst oil continues to tumble with the price now well below $50 a barrel.

Support can be found at 1088, 1080, 1074, 1045, 1000, 950, 867 and 806. The break of 1130 is very bearish for gold and suggest a return to 1000-1050 in the first instance.

Resistance can be found at 1106, 1110, 1130, 1142, 1147, 1163, 1170, 1175, 1184, 1204, 1208-1210, 1215, 1220-1223, 1235 and 1252-1256. Gold has broken below the 2014 lows and looks be headed much lower.

Today's video for subscribers looks at the recent trading in more detail and our strategy for today's trading session.