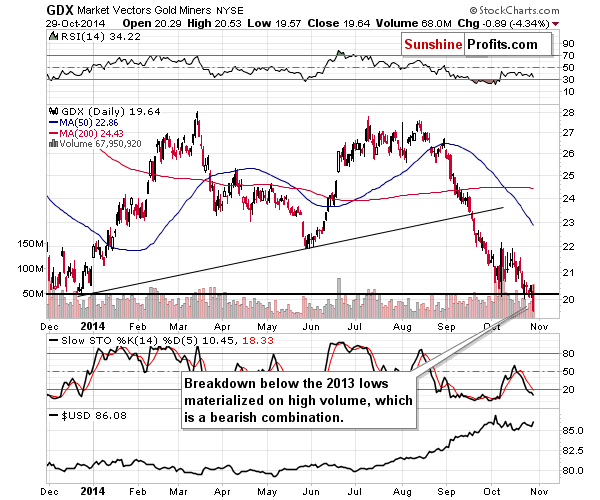

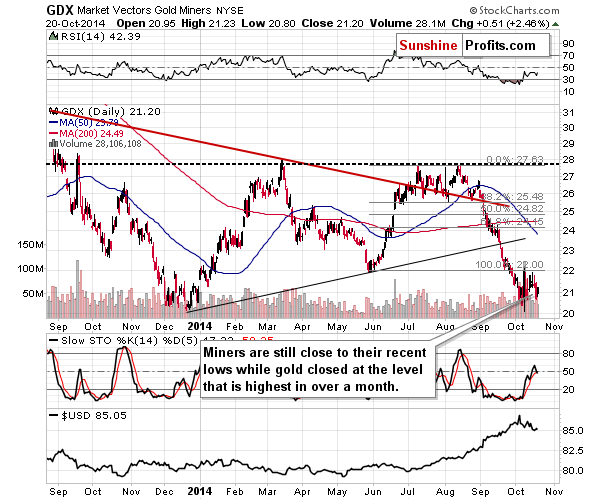

INTERMEDIATE TERM TREND: BEARISH

SHORT TERM TREND: BEARISH

VERY SHORT TERM TREND: BEARISH

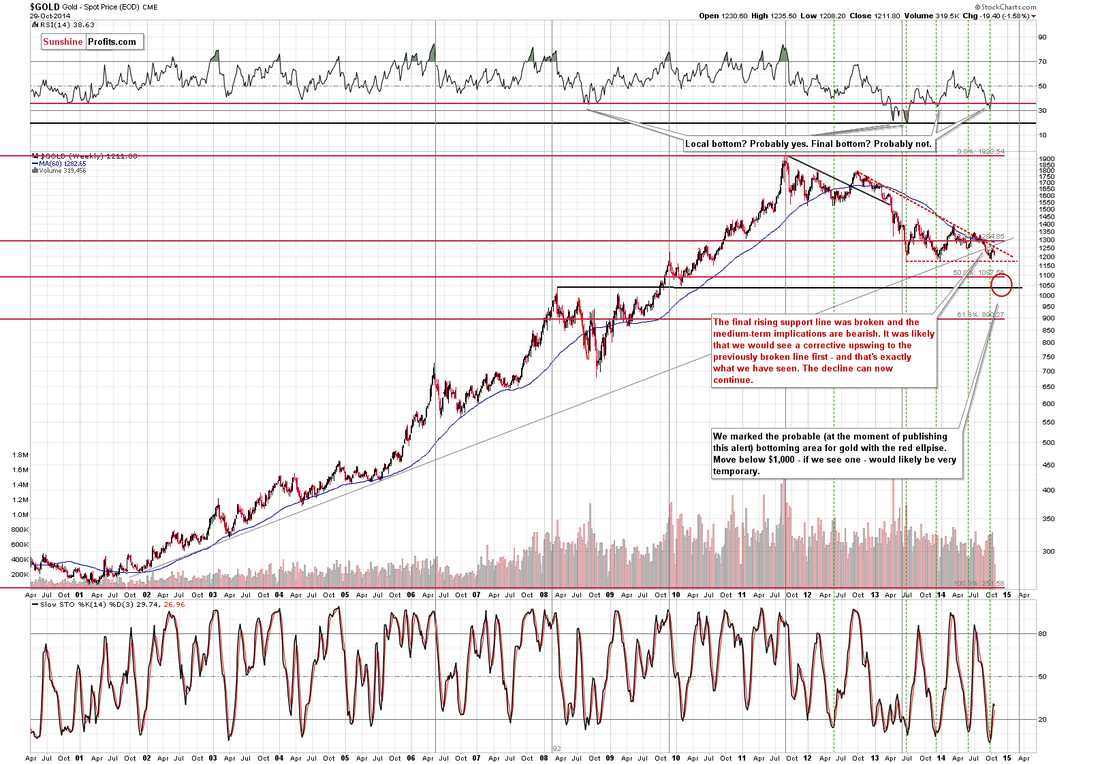

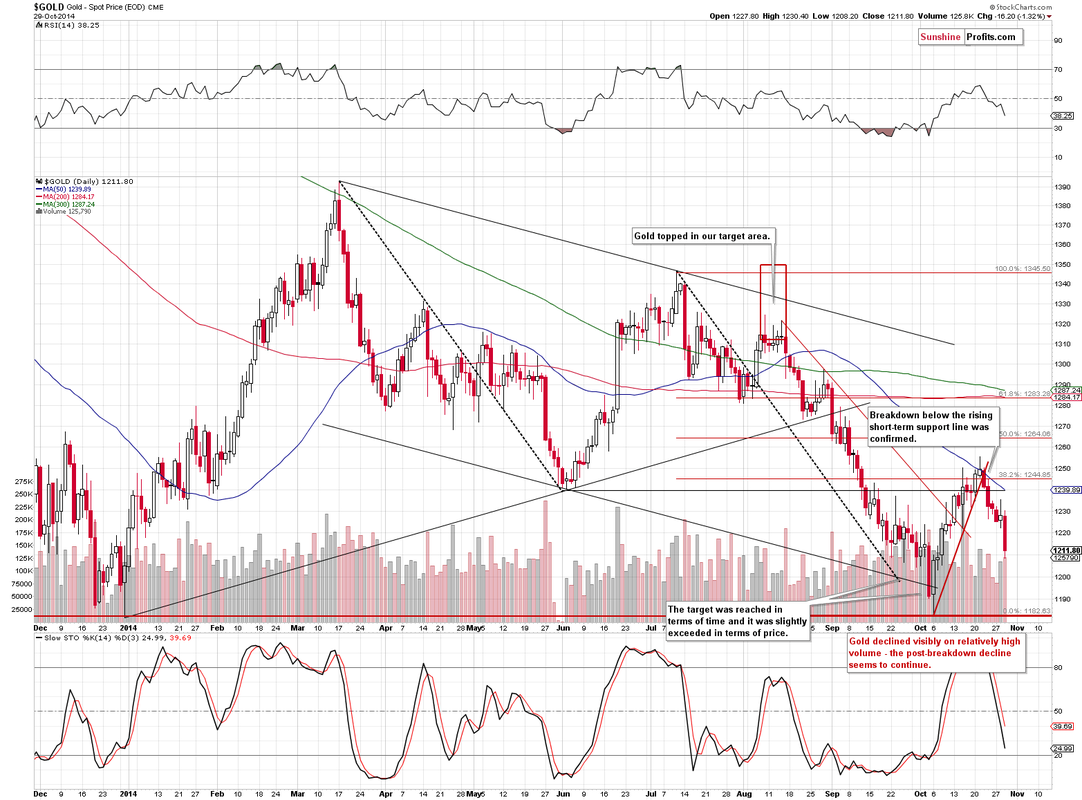

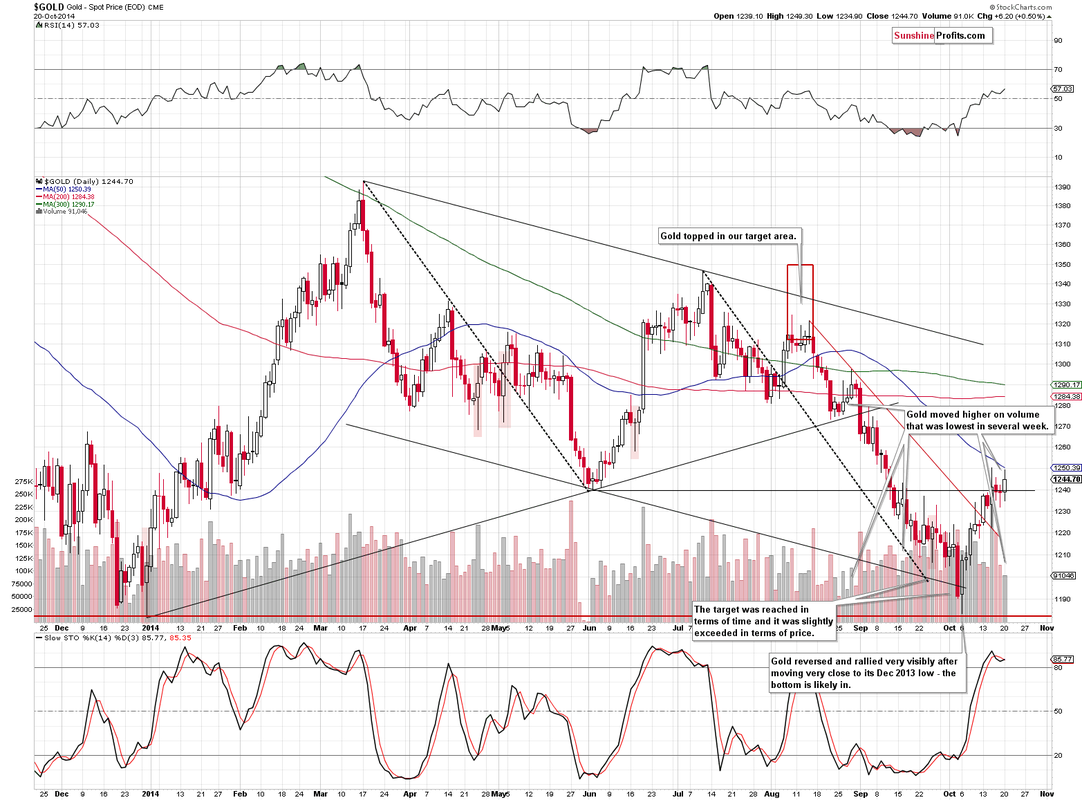

Gold has been crushed overnight, breaking 1200 and rapidly capitulating through the critical 1180 level, falling as low as 1167 before finding some support. The market is currently consolidating just above these lows at 1175, with further declines almost inevitable.

A close below 1180 will confirm the return of the intermediate bear market and suggest a return to 1000-1050 in the short term, with even lower prices possible next year.

We have been calling for this scenario for months and our subscribers are already well placed in the market to take advantage of what is likely to be the trade of the year.

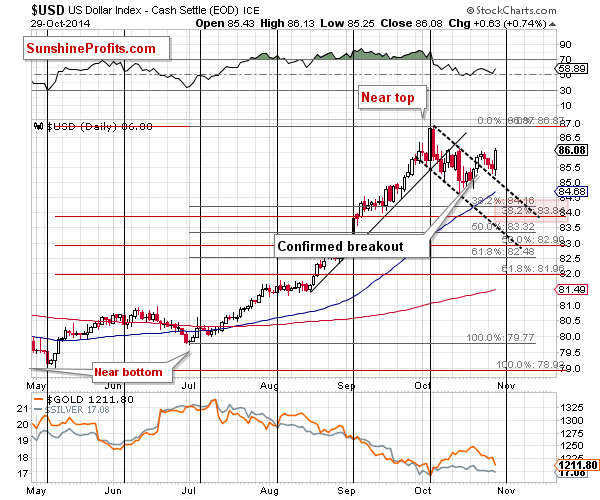

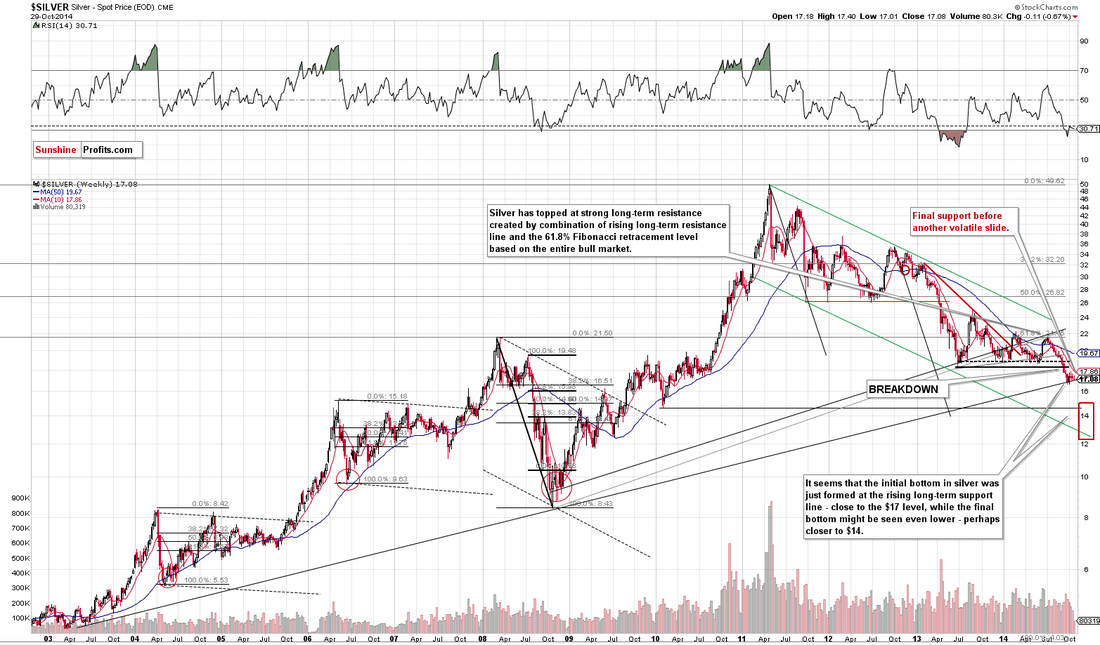

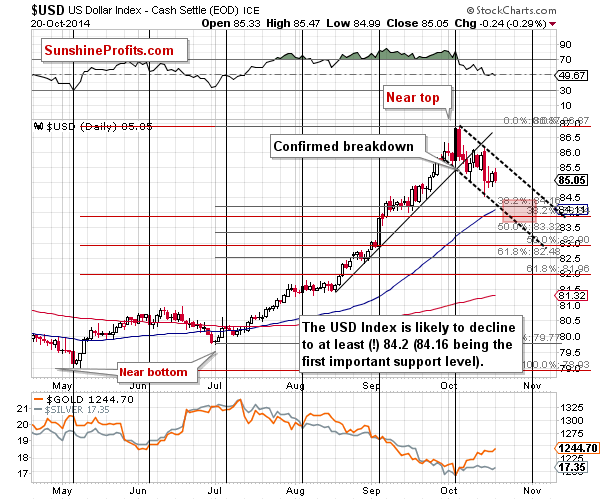

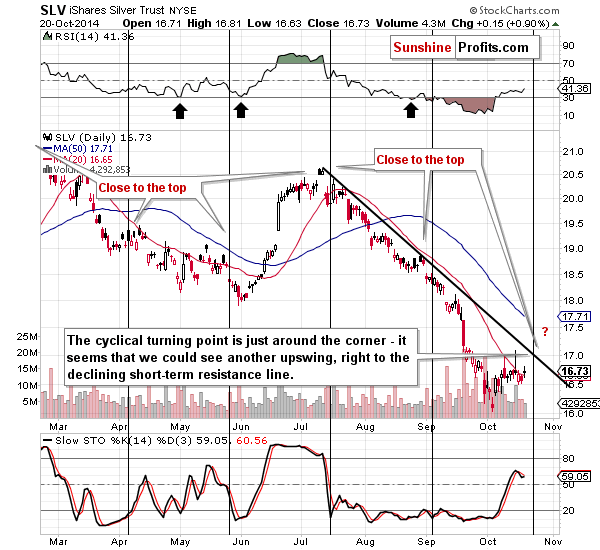

Silver is leading the precious metals lower and has been signalling this move for weeks, with oil tumbling towards $80, equities surging towards all time highs and the dollar rampant again.

Support can be found at 1167, 1158-1161, 1145, 1124, 1100, 1085, 1045 and 1000 . The break of 1180 has serious bearish implications for gold and suggests a decline to 1000-1050 in the short term.

Resistance can be found at 1180, 1200, 1217, 1225, 1232, 1235, 1250, 1255, 1263, 1271-1273, 1290-1292, 1300-1302, 1310-1312, 1322-1325, 1333-1335 and 1345. A second failure to break through the key 65 week MA confirms that the intermediate down trend is intact and the break of 1180 suggests the bears are in full control.

Today's video for subscribers looks at the recent trading in more detail and our strategy for our current trading positions.