INTERMEDIATE TERM TREND: NEUTRAL/BEARISH

SHORT TERM TREND: BEARISH

VERY SHORT TERM TREND: NEUTRAL

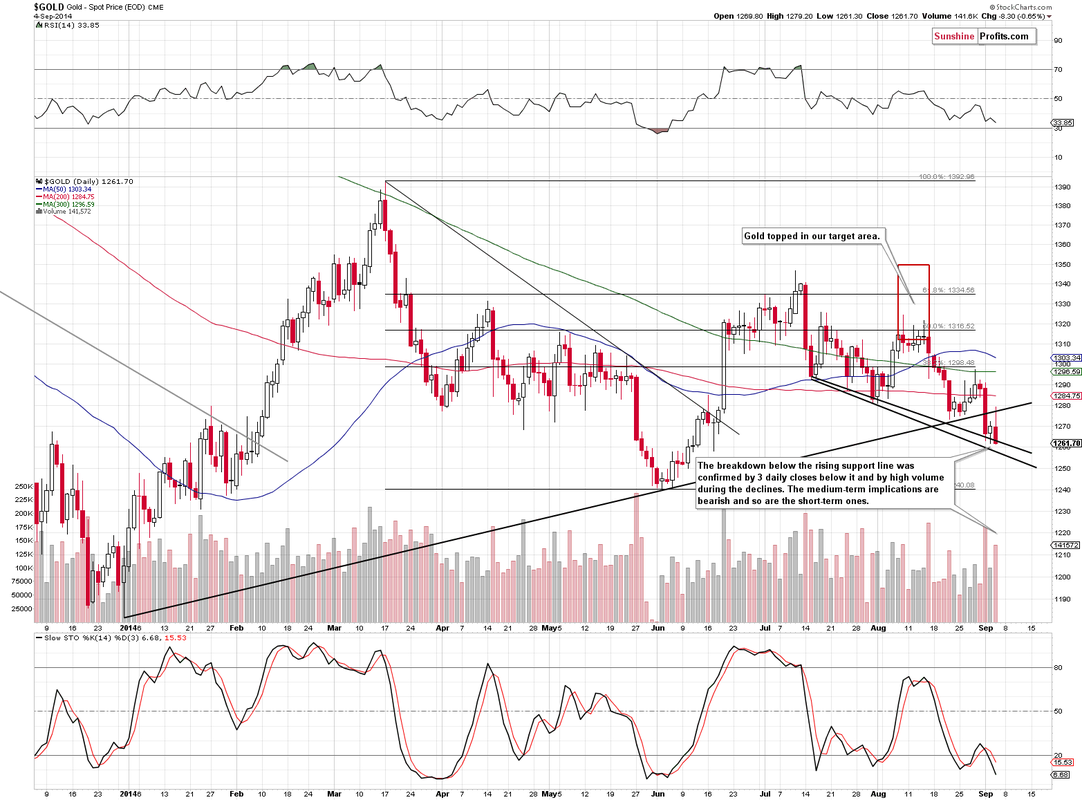

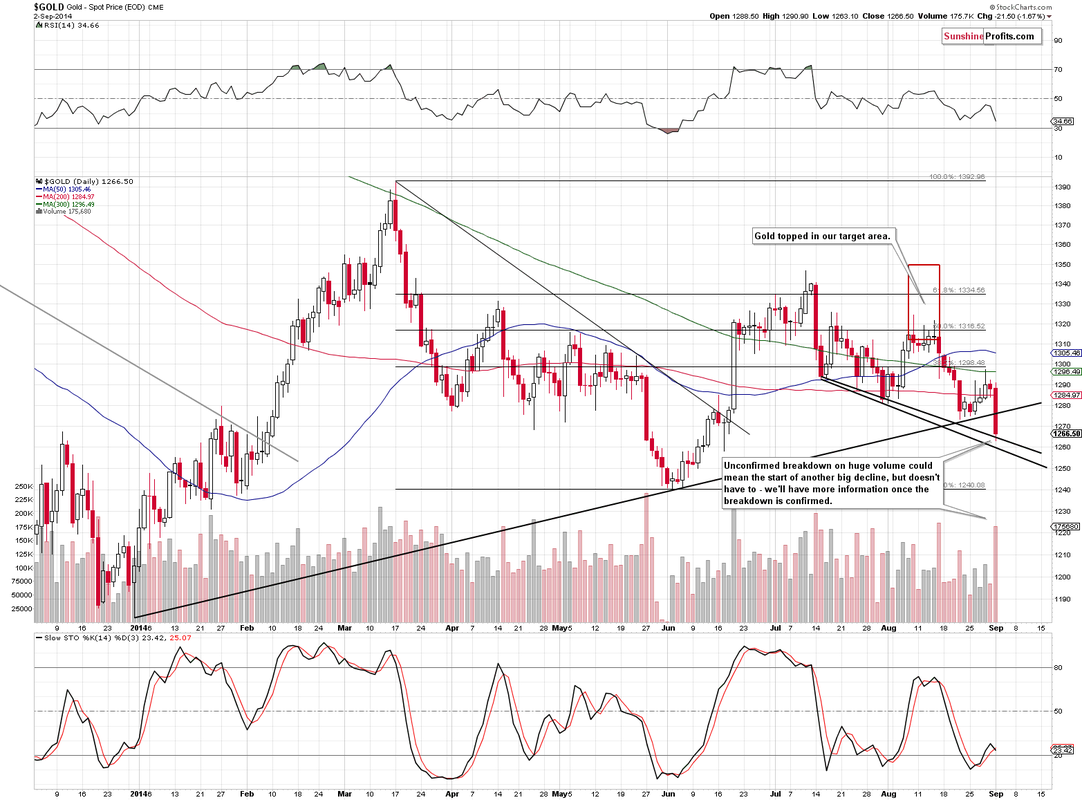

Gold fell as low as 1207 in the early hours of Thursday before rebounding, forming a "double bottom" and a "hammer" reversal on the daily chart. This morning, gold is building on yesterday's gains and a short term bottom appears to be forming.

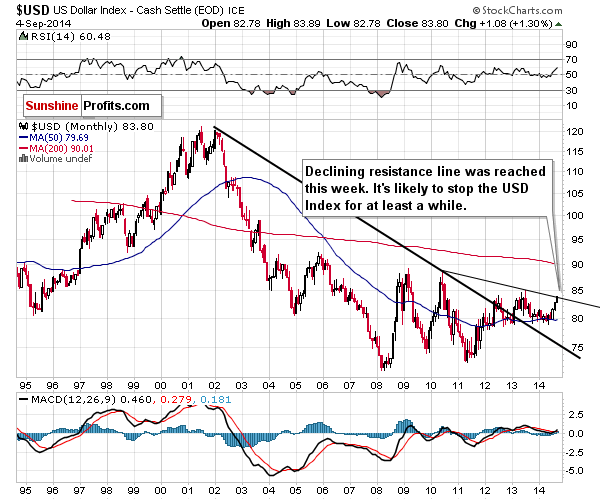

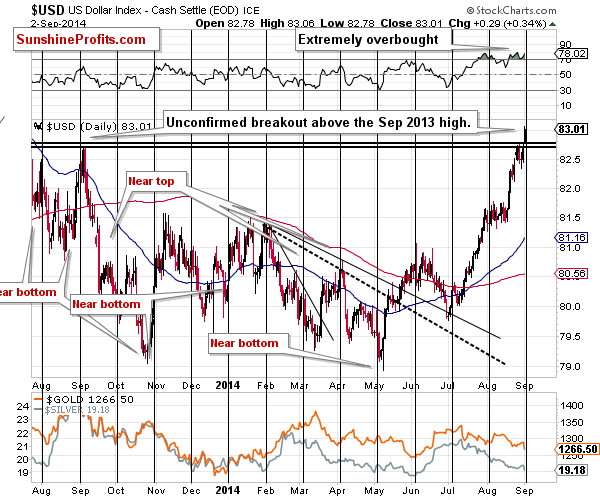

However, the down trend is still firmly in place and we expect the selling to resume after a short rally. The dollar rally has taken the index well above 85, though ysterday's "shooting star" candlestick suggests a retracement is likely in the short term.

Equities fell sharply yesterday. giving gold a boost though the long term uptrend remains intact.

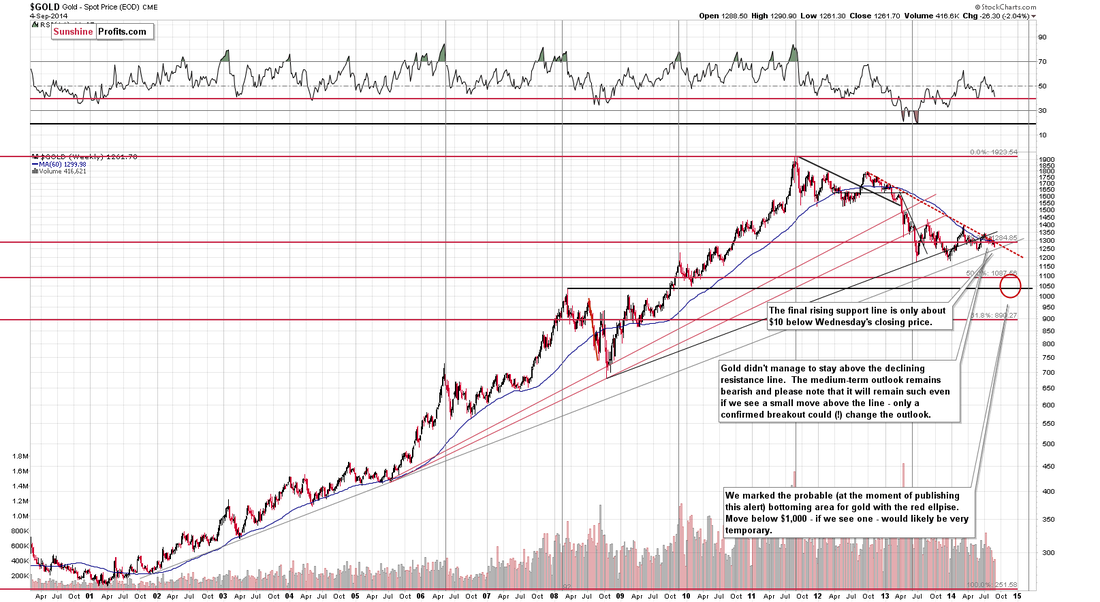

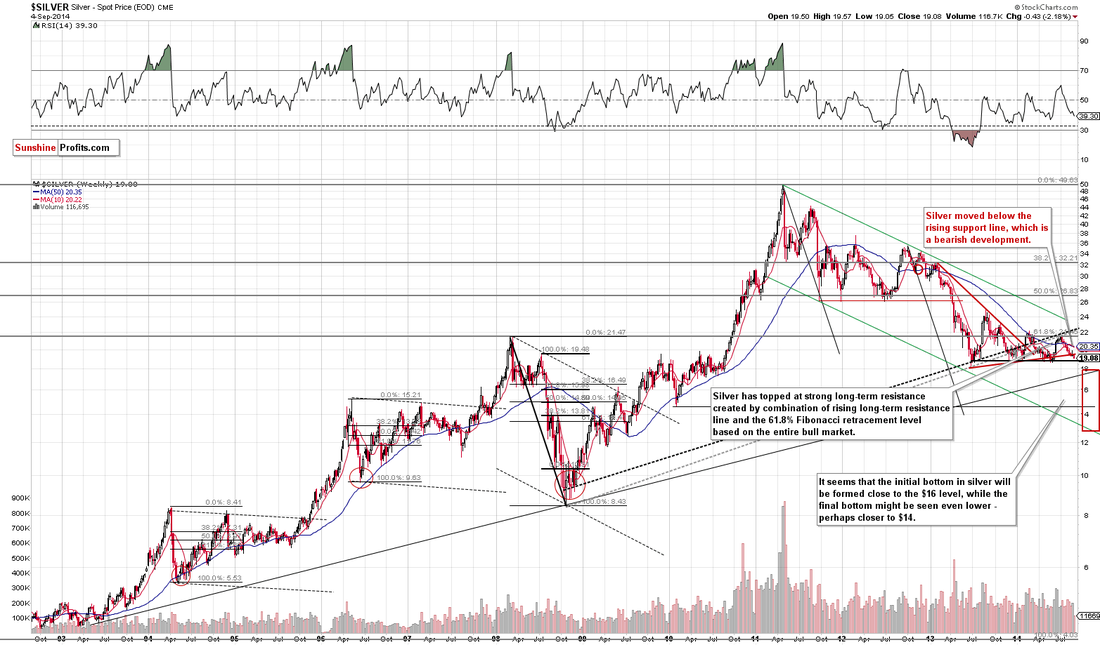

Support can be found at 1208-1210, 1200 and 1180. A break of 1180 would have serious bearish implications for gold and suggest a decline to 1000-1050 in the short term - the failure to break the 65 week MA and the break down of the triangle pattern on the daily chart has make this scenario much more likely.

Resistance can be found at 1231, 1235, 1242, 1257-1258, 1263, 1271-1273, 1277, 1290-1292, 1300-1302, 1310-1312, 1322-1325, 1333-1335, 1340-1342, 1352-1354 and 1392-1395. A second failure to break through the key 65 week MA suggests that the intermediate down trend is intact and a retest of 1180 is now likely.

Today's video for subscribers looks at the recent trading in more detail and our strategy for our next trade.