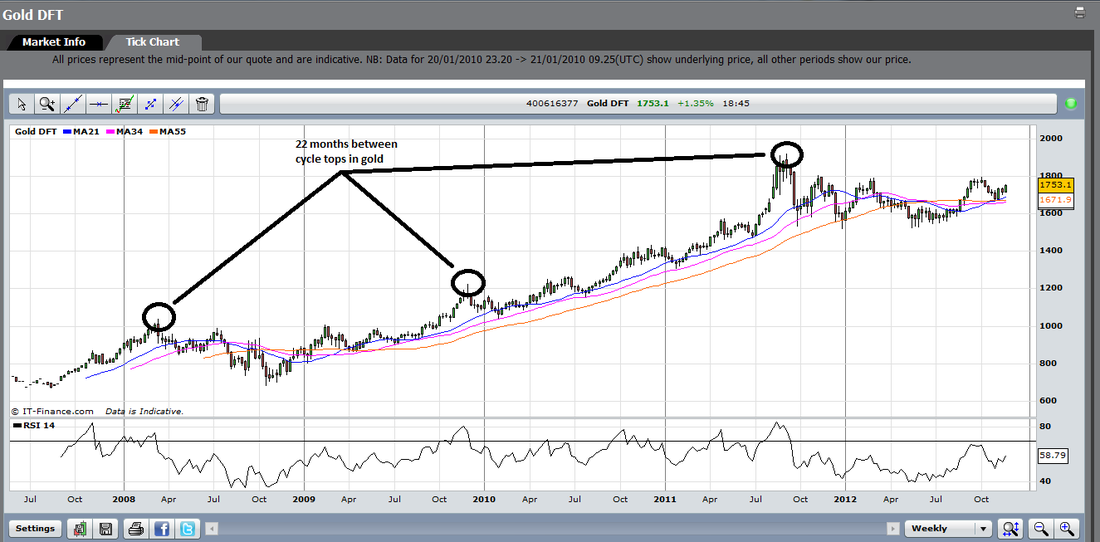

We believe gold will break back through this resistance and the 50 DMA, possibly today, and move towards 1755 again. Once through there, 1800 should quickly come back into range.

For our subscribers at www.goldtradingexperts.com, today's video looks at the recovery from Wednesday's lows at 1705 and an important trend line on the daily chart.