That’s three wins in a row over the past week or so, marking a really strong finish to February and start to March. Let’s take a quick look at today’s trade…

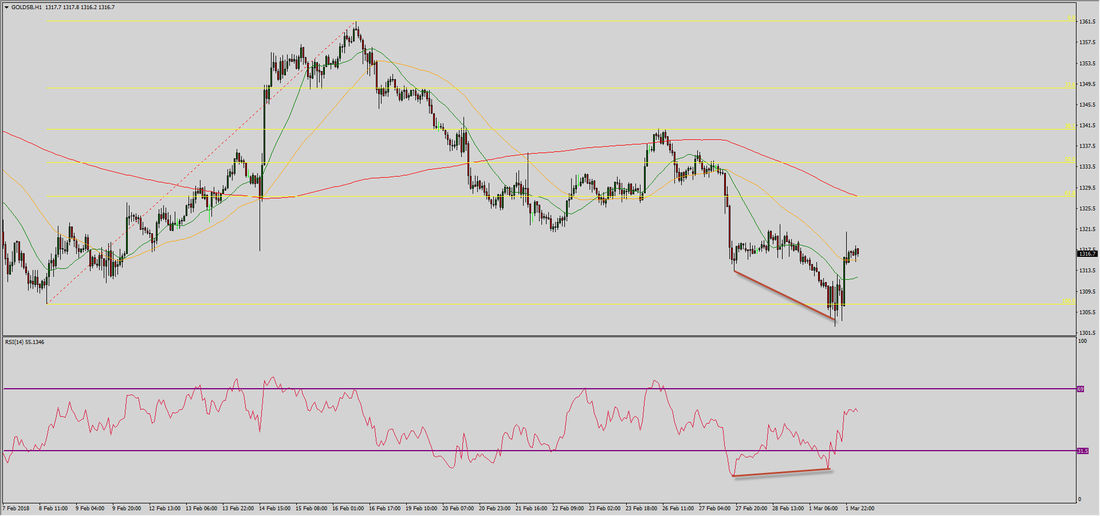

We entered this trade in the early hours – 3:12am on the GKFX clock, at 1326 – with our stop at 1329.6 and a target of 1319.

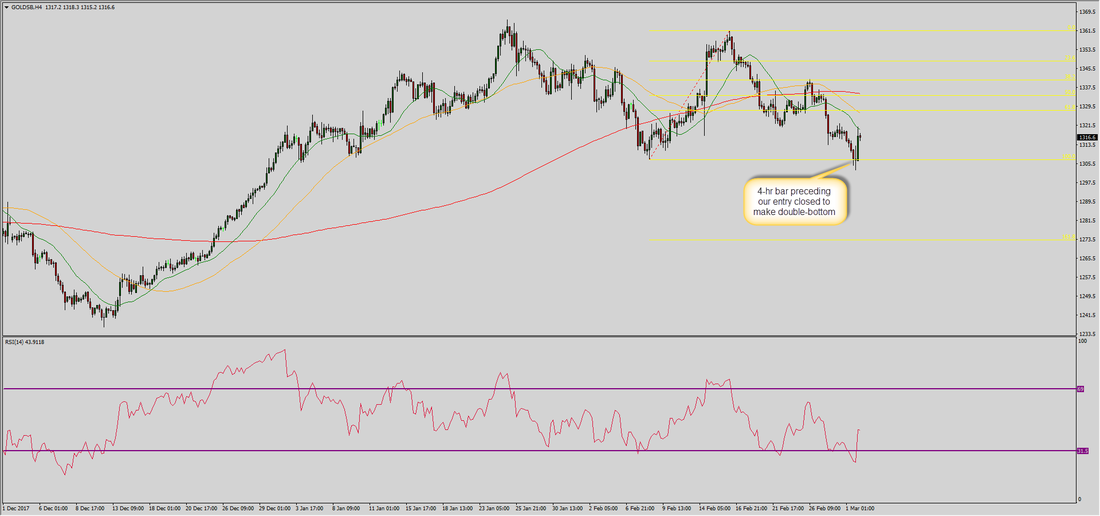

The chart below is the daily – we’ve got the 20-day Moving Average at 1329 and the 50-day at 1327, converging to form an area of resistance. This put our automated trading algorithm on alert for a reversal set up.

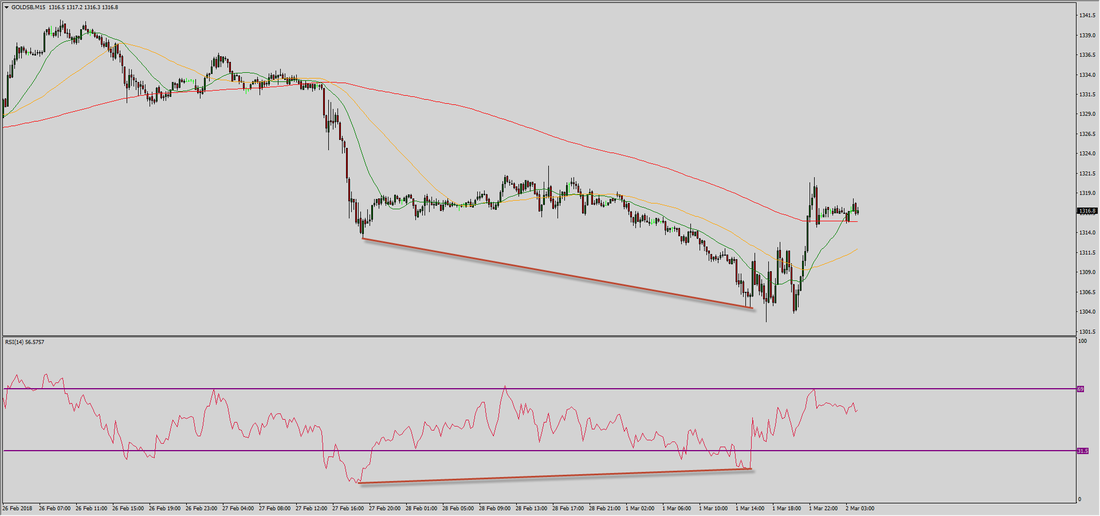

The next chart we have below is the 15m – notice here how the 3am bar makes a higher-high whilst he RSI high is lower than earlier highs, giving us bearish RSI divergence.

This one took a little while to move in our direction – but as you can see from the charts above, price rolled over as expected and moved towards our target. We jumped out a little earlier than planned as the delay in price falling has led to moving averages on the 15m and hourly chart moving towards price to near our target. We felt this would (and actually it has) build support around 1320 which may lead to a bounce. We’d rather bag the points than hold out in hope where we’re this close.

We’re currently flat and waiting for our next set up.

Thanks as always for following us.