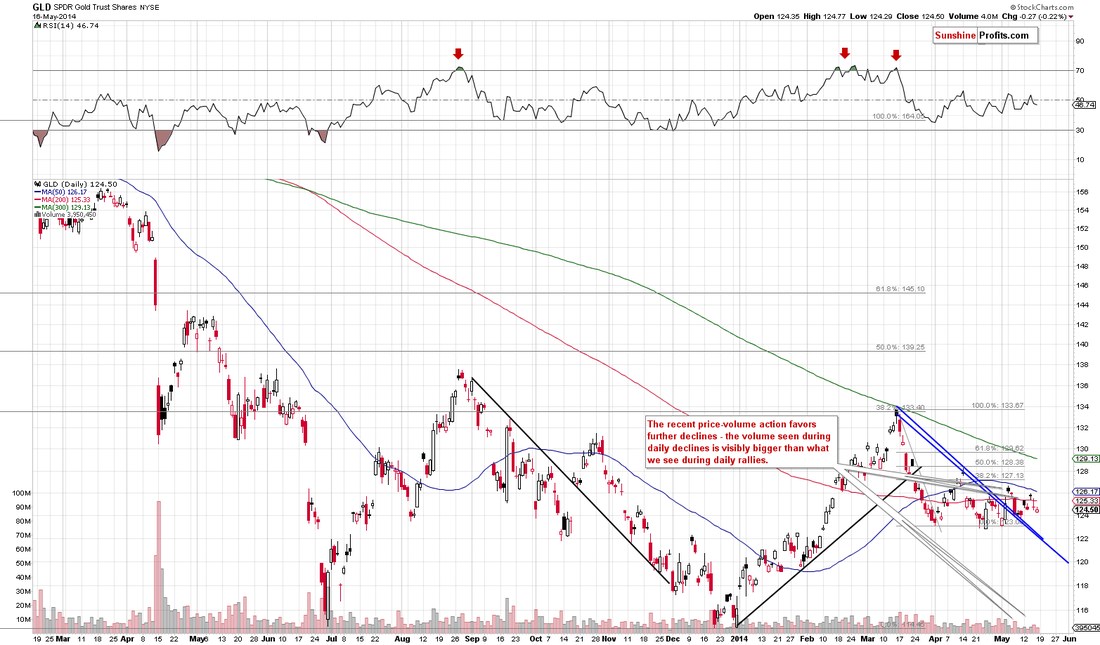

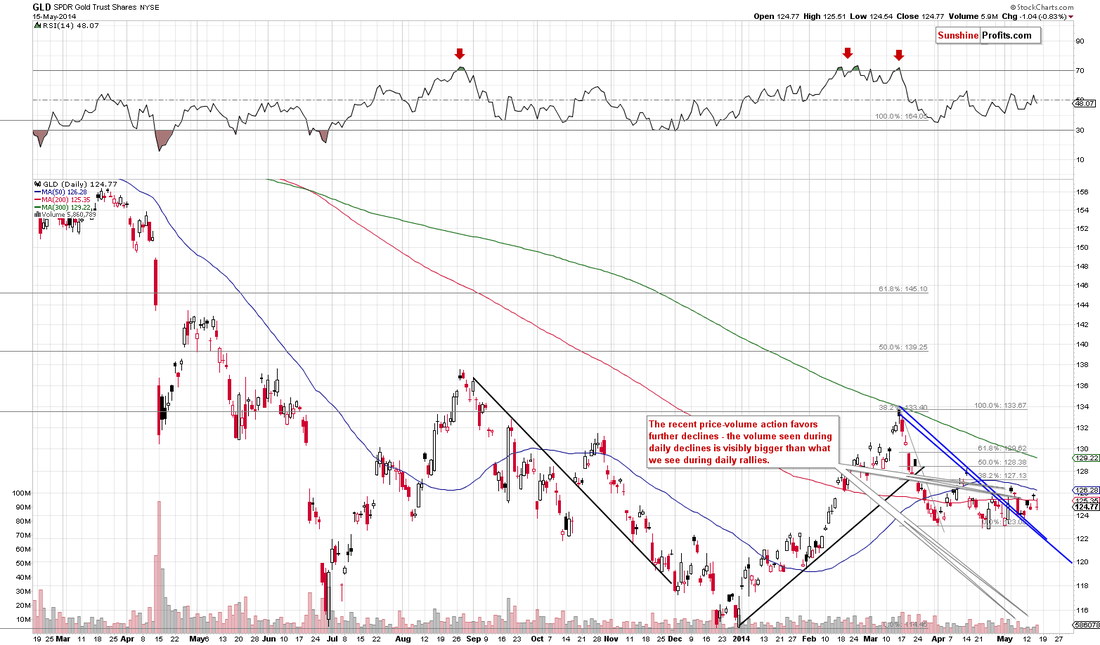

The RSI is very oversold on the 4 hour chart, suggesting a short term bounce is near, though we expect the 80 or 200 hour MA to provide resistance on any counter trend rally, with a return to 1180 now looking more likely than a return to 1300.

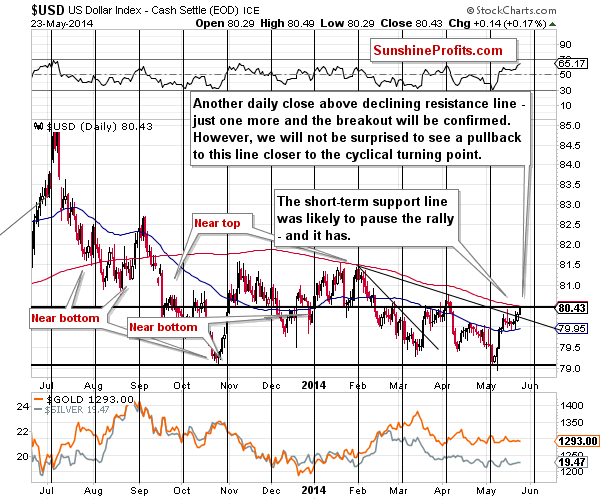

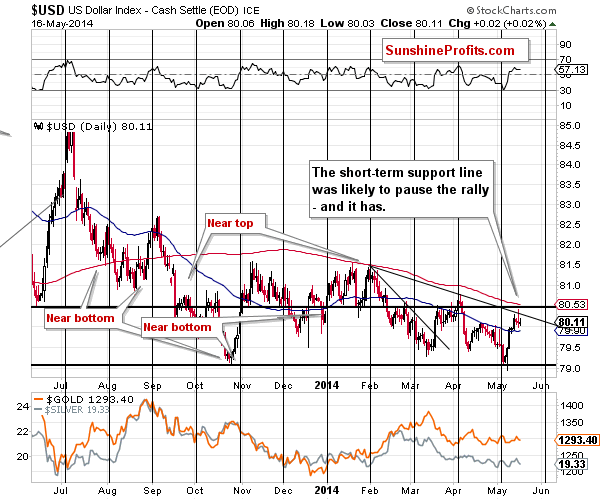

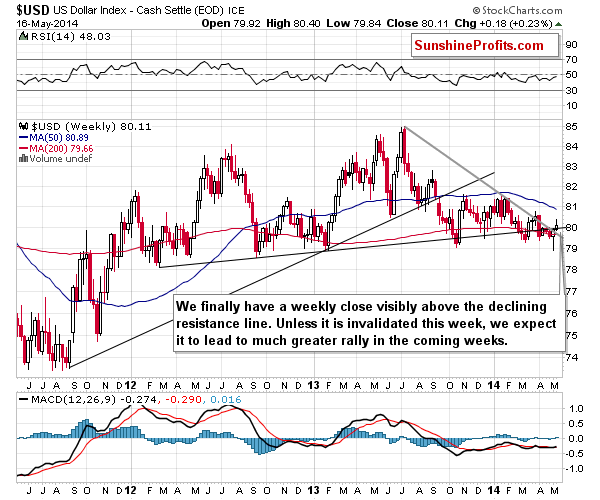

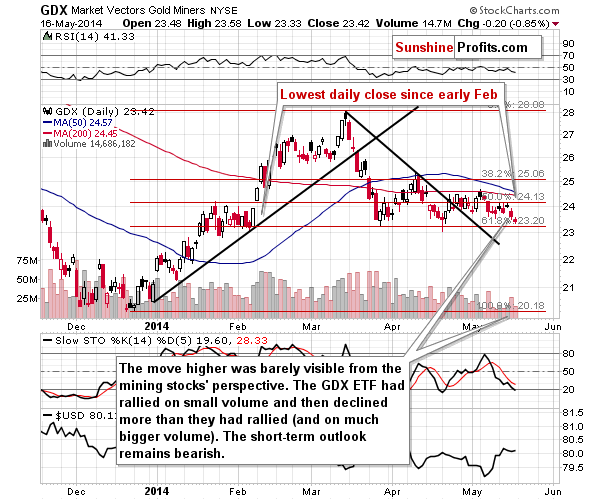

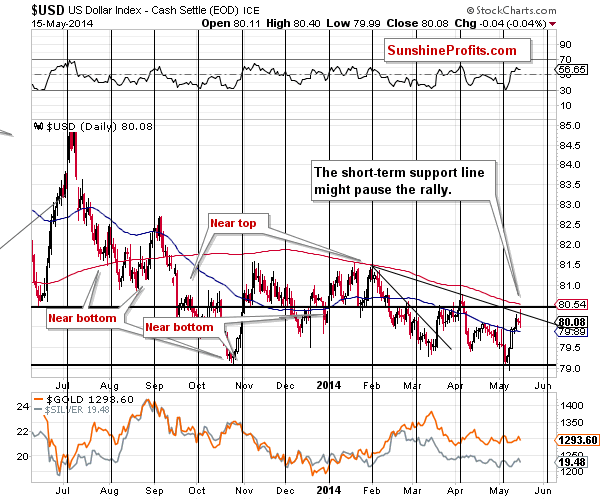

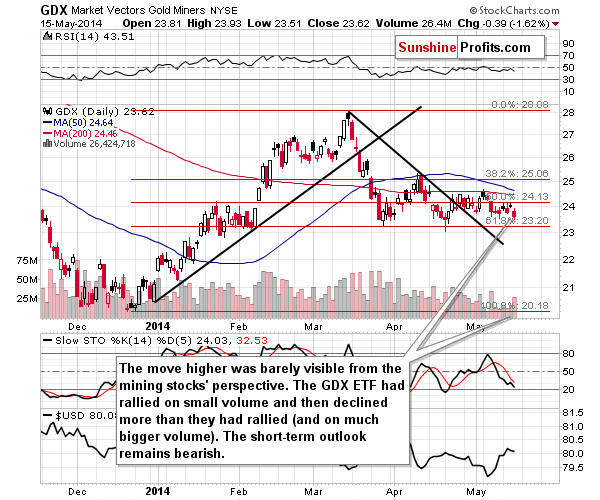

Equities are at all time highs and have broken above stiff resistance, suggesting a powerful new up leg is underway. The dollar strength is also continuing, pressuring gold further.

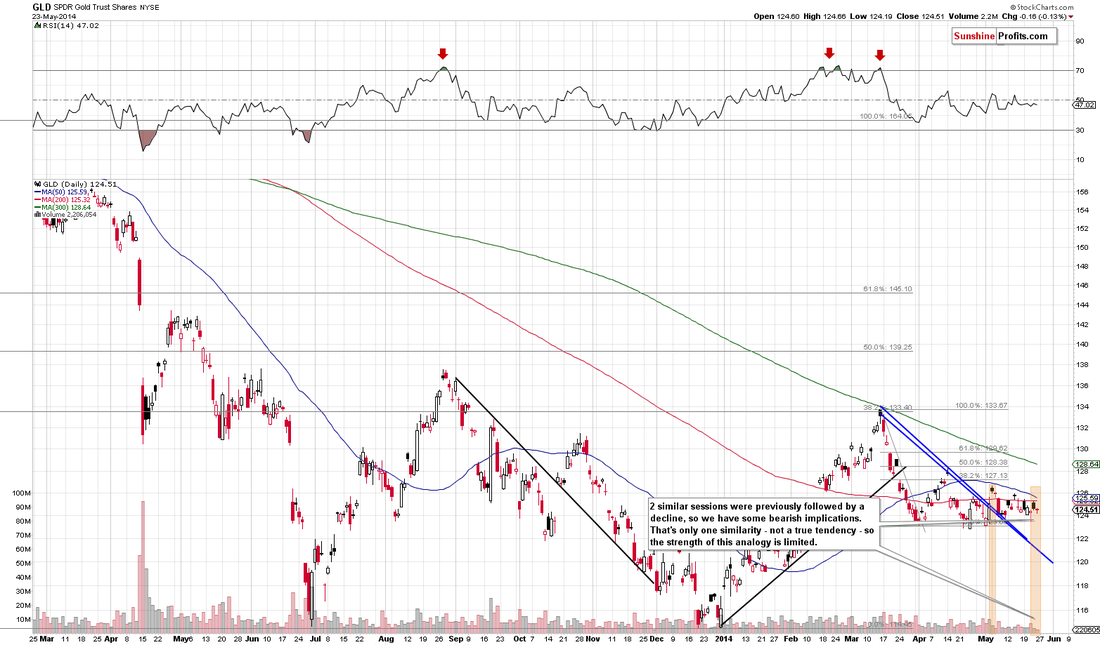

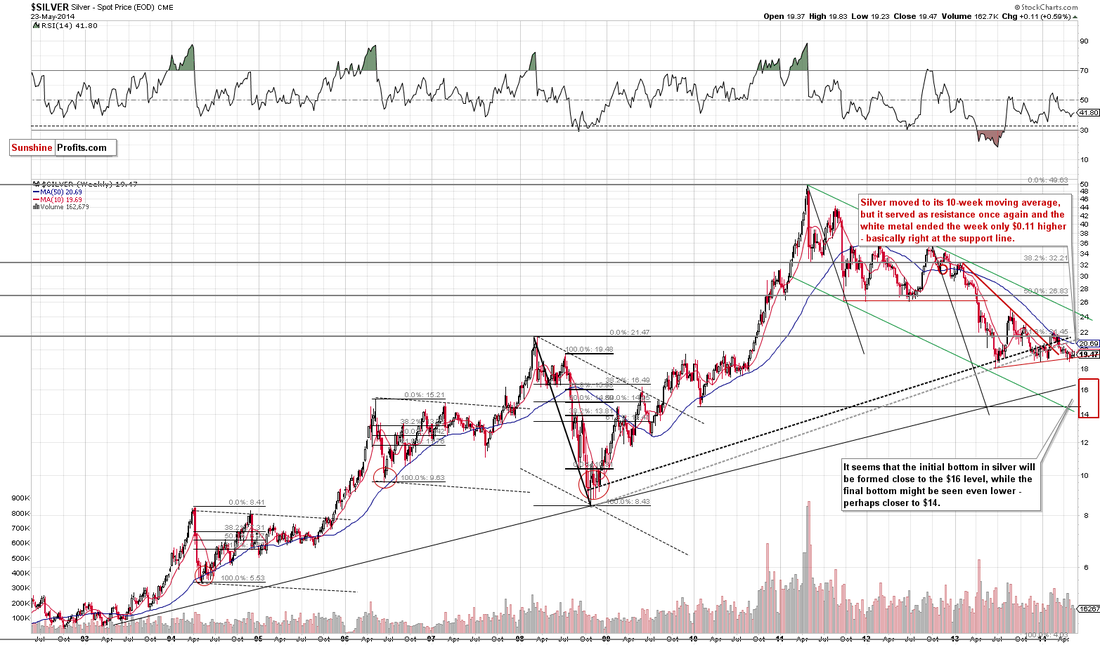

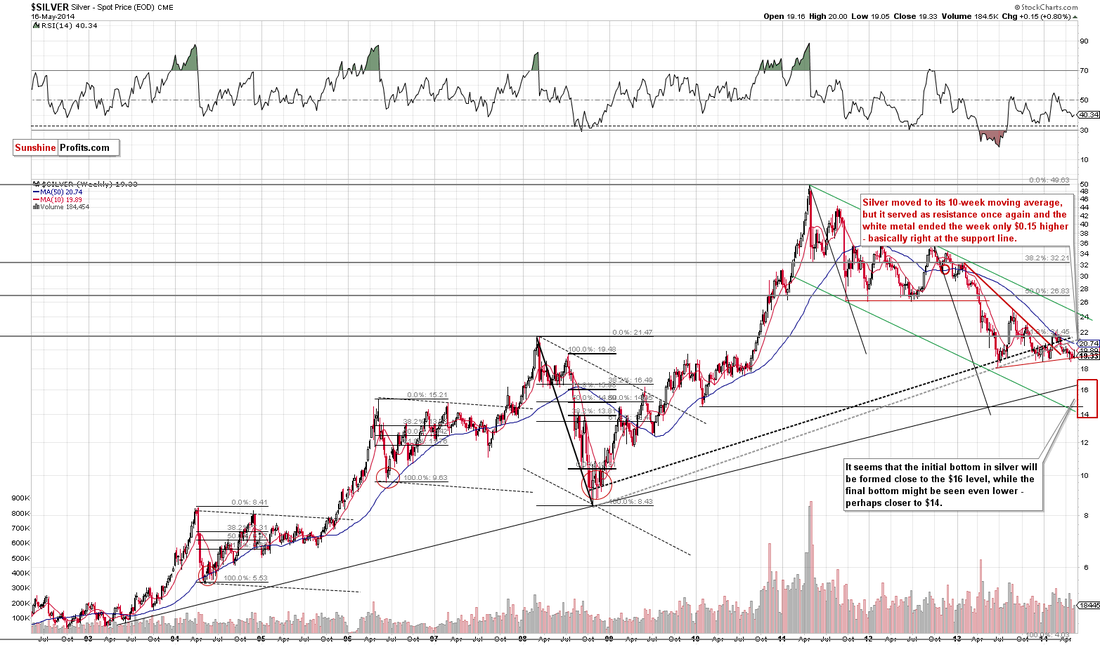

Support can be found at 1250-1255, 1237-1240, 1220-1225, 1210, 1200 and 1180. A break of 1180 would have serious bearish implications for gold and suggest a decline to 1000-1050 in the short term - this prospect now looks more likely and we are watching for a break below 1250 for confirmation of a likely return to 1180.

Resistance can be found at 1260, 1268, 1274-1277, 1283, 1289, 1293-1296, 1304-1305, 1309, 1314-1315, 1319-1322, 1330-1332, 1340-1342, 1352-1354, 1392-1395, 1400, 1420 and 1435. The impulsive breakout above the first down trend line on the weekly chart suggests an end to the intermediate term down trend, however the 65 week MA must be broken before a significant rally can develop.

Today's video for subscribers looks at the unfolding decline in more detail and our strategy for our next trade.