INTERMEDIATE TERM TREND: NEUTRAL

SHORT TERM TREND: BULLISH

VERY SHORT TERM TREND: BEARISH

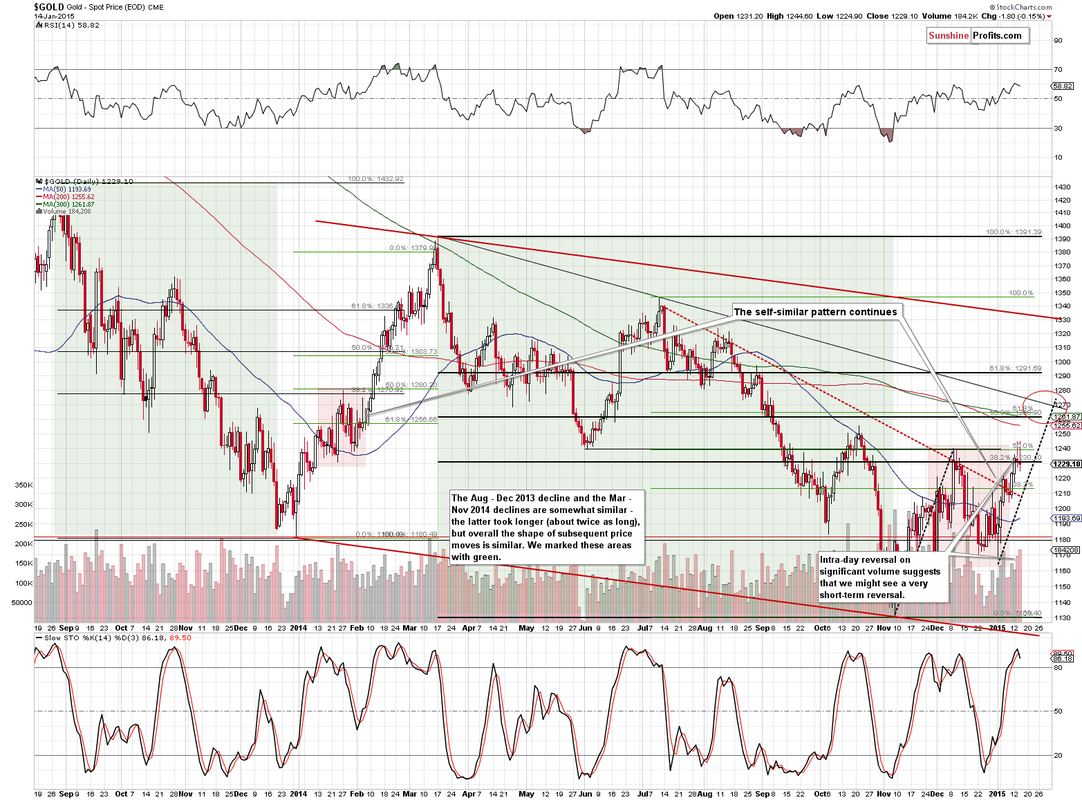

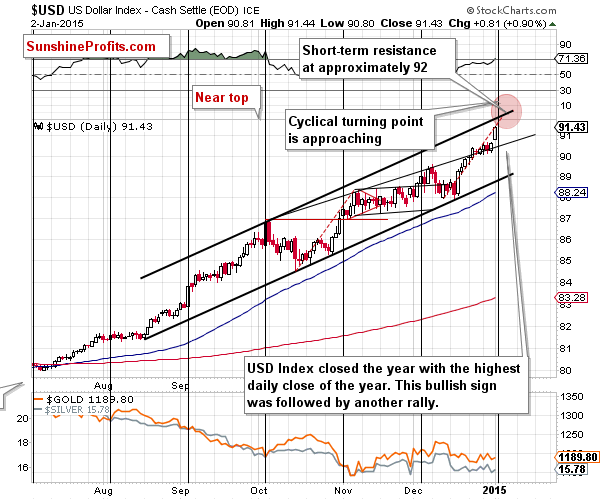

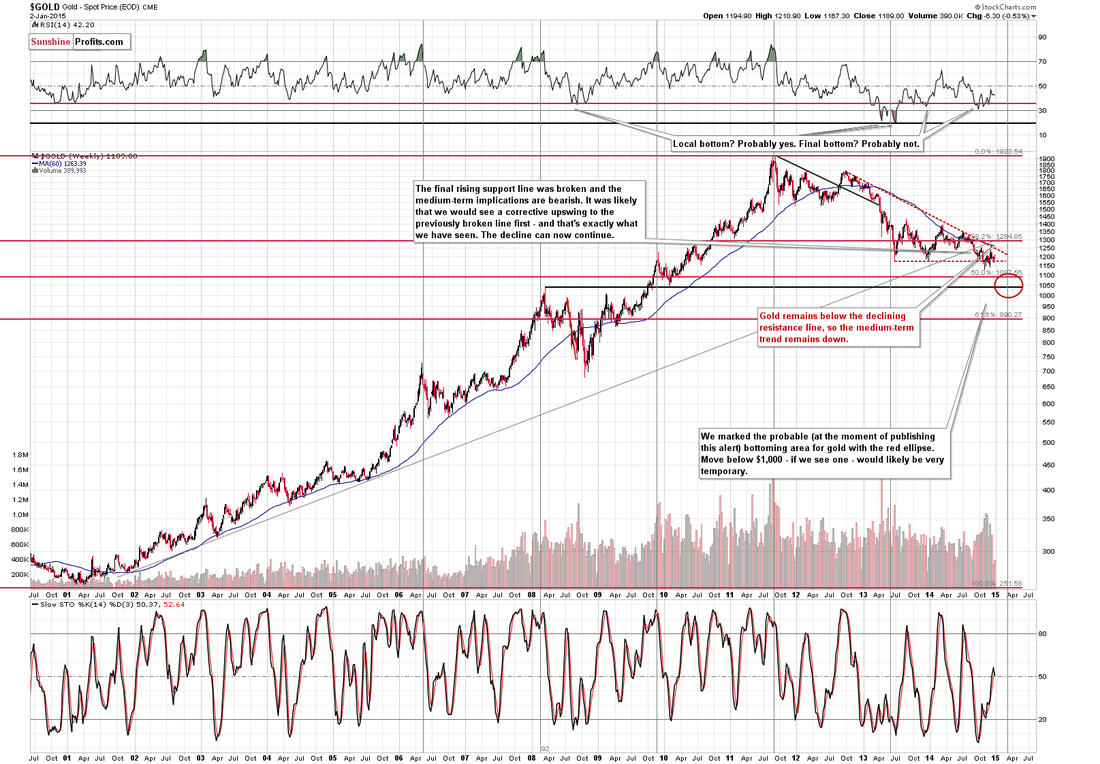

After finding resistance at 1305 last week, gold has started to correct as we predicted, with the low of 1272 so far coming in at the 23.6% Fib retracement of the rally from 1167 to 1305.

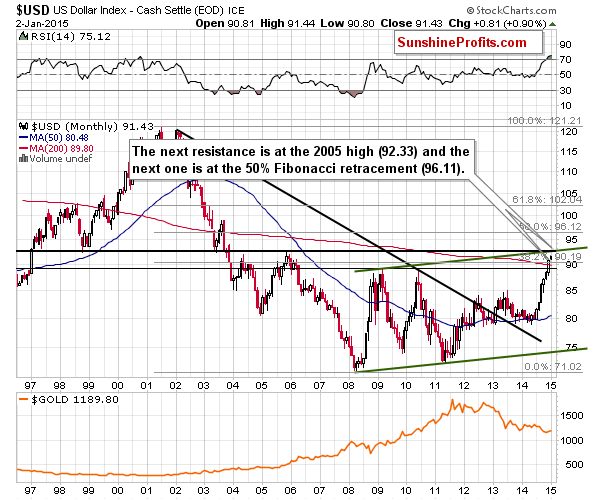

We expect the rally to continue once the current correction has run it's course (our subscribers are aware of our targets for the correction) despite the continuing dollar strength. It appears that both gold and the dollar are benefiting from the "safe haven" trade, particularly in respect of European investors worried about the short term weakness in (and the long term viability of) the Euro.

Equities remain well off all time highs, however any declines are being seen as buying opportunities as the indices make their way higher - the non existent inflation and dim prospects for interest rate rises make the dividend yields on blue chip equities appealing even as stock prices rise.

Oil remains firmly entrenched in a down trend with new lows below $45 a barrel seen yesterday.

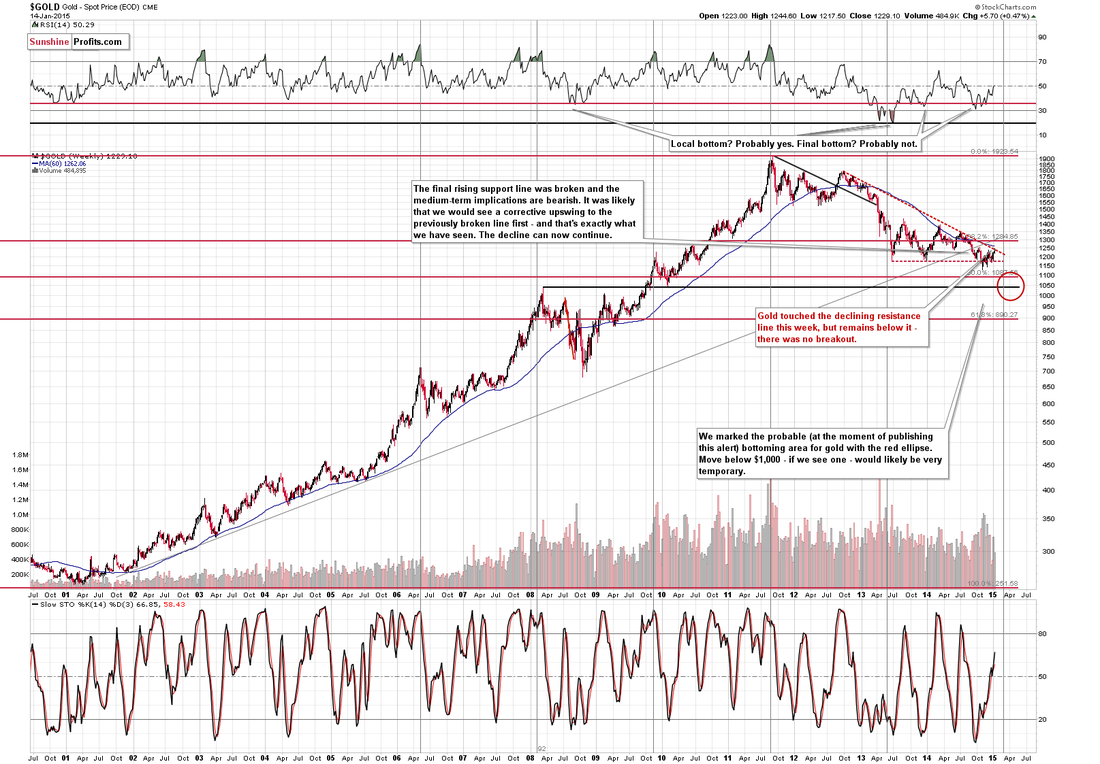

Support can be found at 1272, 1268, 1256, 1245, 1222-1225, 1210, 1204, 1200, 1192, 1180-1183, 1175-1178, 1172, 1167, 1154, 1145-1147, 1131, 1124, 1100, 1085, 1045 and 1000. Gold has bounced back after breaking below the critical 1180 level and is now moving higher after a classic "bear trap". The break of the intermediate down trend suggests a new rally phase is just beginning.

Resistance can be found at 1282-1284, 1290-1292, 1300-1302, 1305, 1310-1312, 1322-1325, 1333-1335 and 1345. The break of the intermediate down trend line in an impulsive move higher suggests an end to the down trend and the start of a new rally leg in gold.

Today's video for subscribers looks at the recent trading in more detail and our strategy for today's trading session.