INTERMEDIATE TERM TREND: BEARISH/NEUTRAL

SHORT TERM TREND: NEUTRAL

VERY SHORT TERM TREND: NEUTRAL

As we mentioned in our previous blog, gold has settled into a range oscillating around 1200 for the remainder of the year.

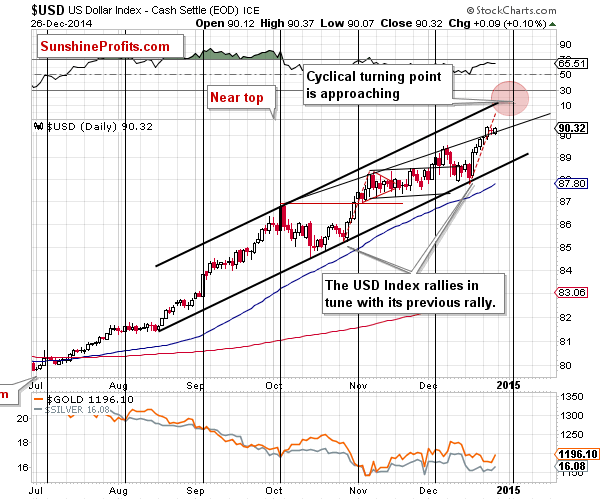

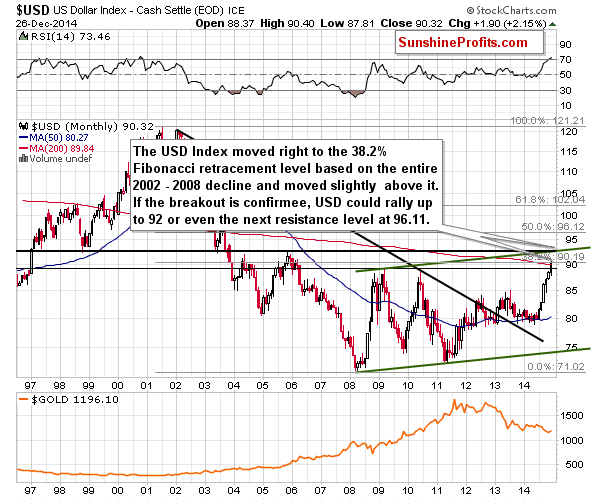

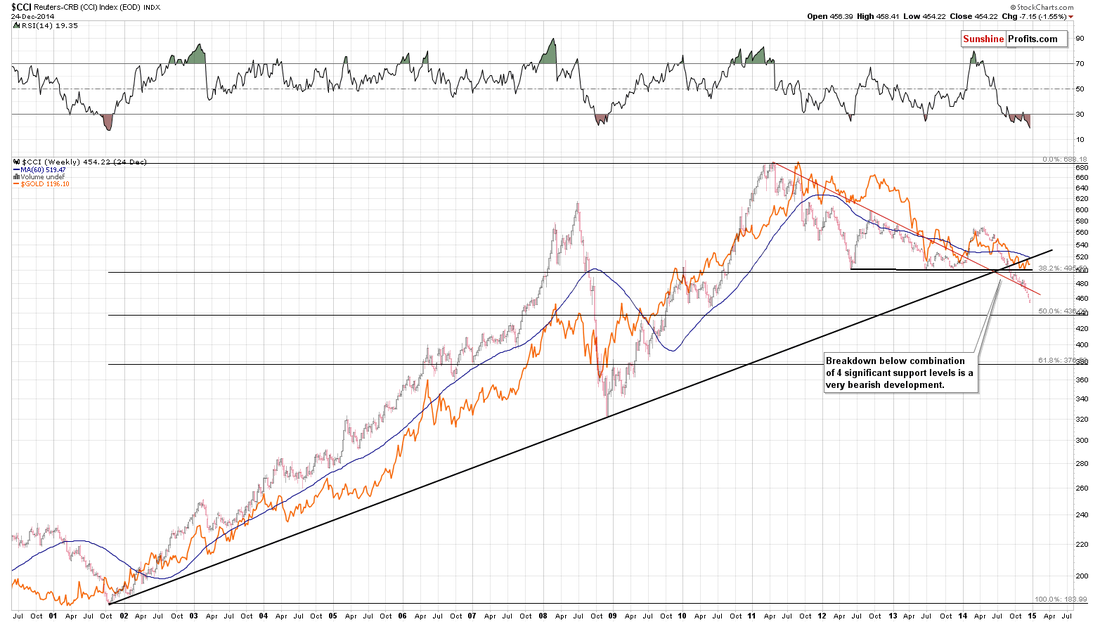

The outlook for 2015 appears weak for gold, with equities at all time highs, the dollar powering higher above 90 and at multi-year highs and oil continuing its precitpitous fall that has been the talk of the last quarter of 2014.

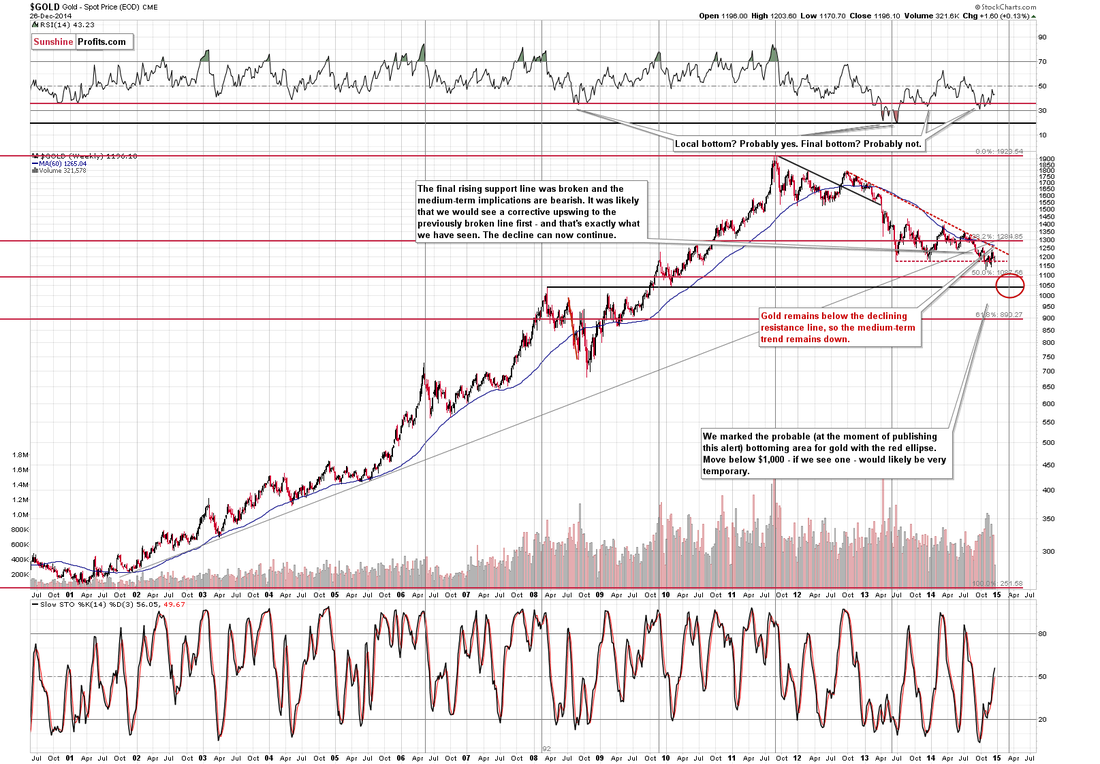

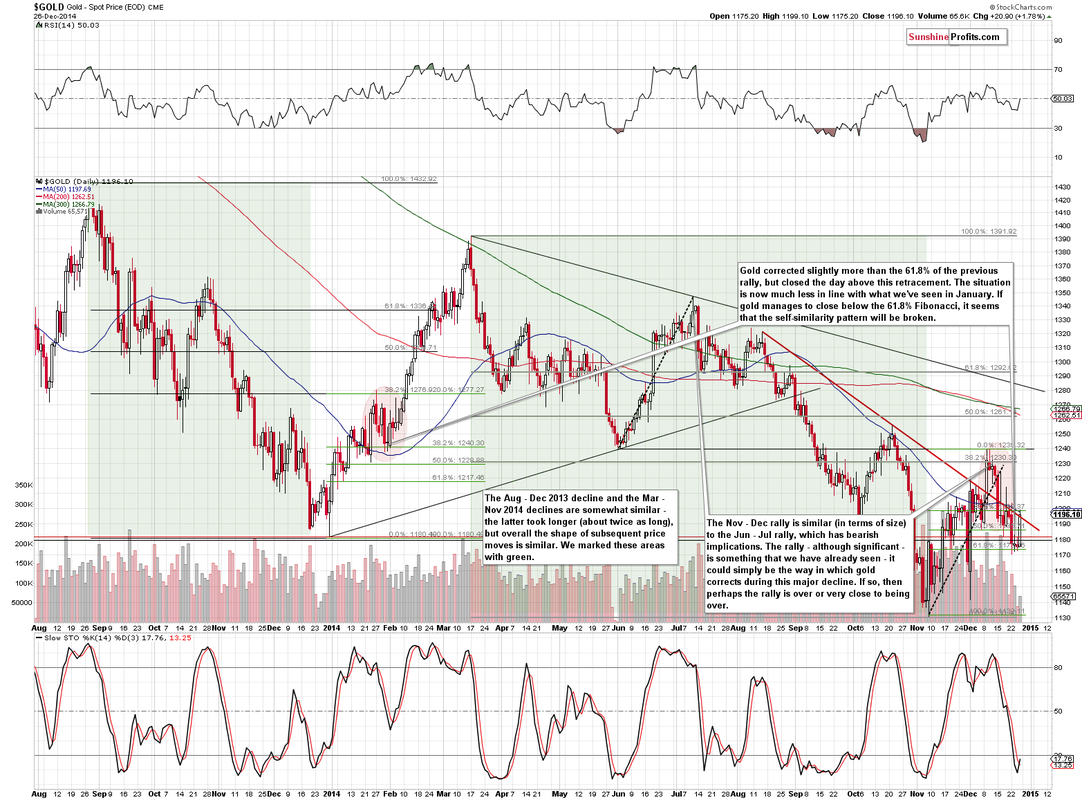

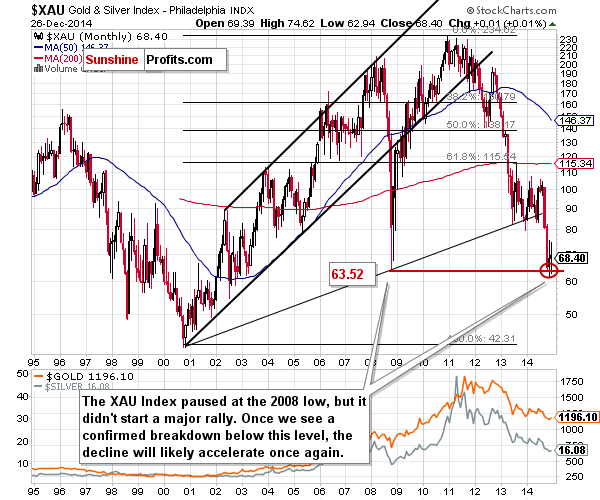

We will be watching for a break below 1131 early next year to confirm our long term 1000 target, with the bulls needing to break 1245 to reverse the downtrend. Longer term, a slew of moving averages below 1300 will provide stiff resistance should gold break this initial target.

Support can be found at 1180-1183, 1175-1178, 1154, 1145-1147, 1131, 1124, 1100, 1085, 1045 and 1000 . Gold has bounced back and appears to be building a base to move higher after breaching the critical 1180 level, in what looks to be a classic "bear trap".

Resistance can be found at 1192, 1198, 1203, 1207, 1213, 1222-1223, 1235-1238, 1250, 1255, 1263, 1271-1273, 1290-1292, 1300-1302, 1310-1312, 1322-1325, 1333-1335 and 1345. A second failure to break through the key 65 week MA confirms that the intermediate down trend is intact however the recent trading suggests the bulls may be building a base for a rally.

Today's video for subscribers looks at the recent trading in more detail and our strategy for today's trading session.