We expect this level, which also coincides with an important down trend line, to provide resistance and would not be surprised to see a sell off from this area.

Although there are no signs of a top yet, RSI is overbought on the daily and 4 hour charts and gold may struggle to move much higher in the short term.

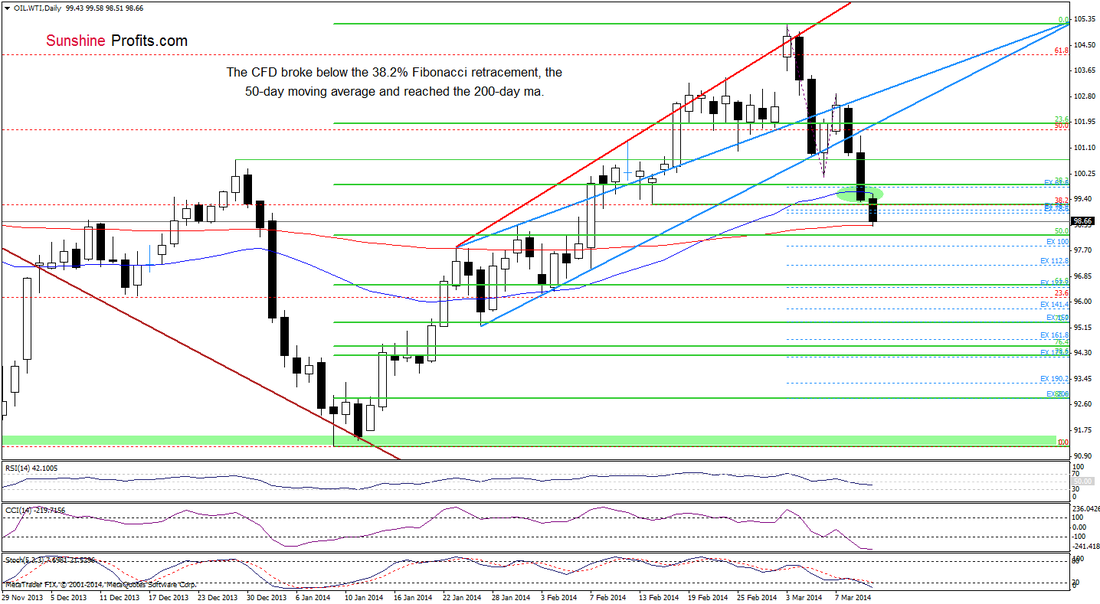

The dollar remains weak, though is holding above 79 and oil has tumbled sharply in recent days to trade around $98 a barrel. This week sees little in the way of economic news and the turmoil in Ukraine appears to have settled down for now, so we may see a quiet week of trading.

Support can be found at 1375-1380, 1360-1363, 1354, 1350, 1340, 1330-1332, 1322, 1312-1315, 1307, 1295-1300 and 1280.

Resistance can be found at 1391, 1395-1400, 1420 and 1435. The breakout above 1300 suggests an end to the intermediate term down trend and that a significant rally is now developing.

Today's video for subscribers looks at the recent trading in more detail and our thoughts for our next trade.