Another winner yesterday – a quick “in and out” for 50 points. Let’s take a quick step through…this case provides a great example of how we use information from multiple timeframes to set up a winning trade, in this instance with signals from the 4-hour chart all the way down to an expertly timed entry from the 1-minute chart.

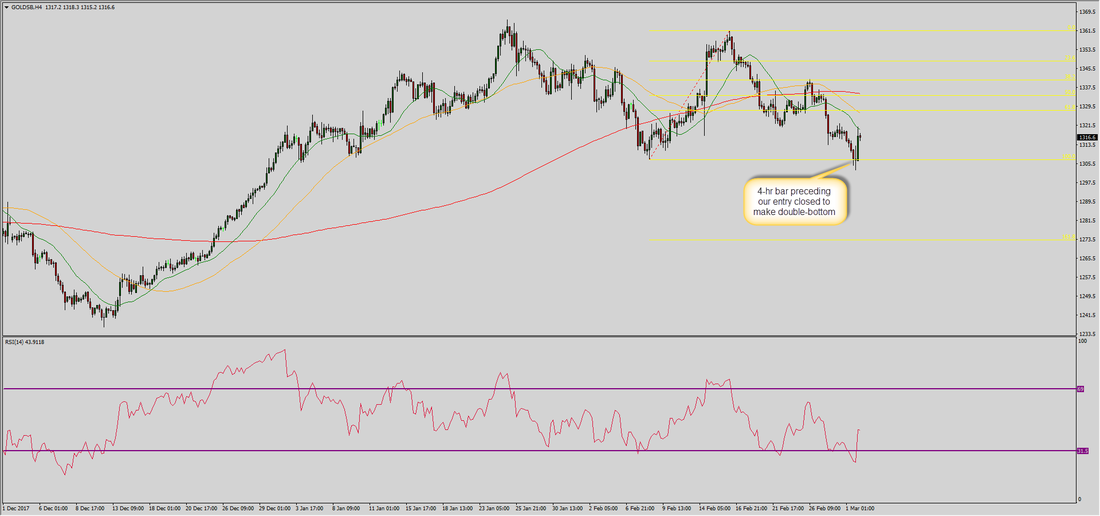

The first chart below is the 4-hour. Our trade was triggered at 17:21 GKFX time (2hrs ahead of the UK) – notice on this chart where the 13:00 4hr bar closed…right on the line of the 100% fib retracement level, effectively making a double-bottom with the low on 8th Feb. Because this is on the 4-hour, it will weigh heavily on the lower timeframes. Also notice RSI is oversold. So we’re now expecting some sort of bounce. It’s also worth noting the proximity to the 1300 level…round numbers such as these tend to form natural support & resistance levels. Again, another clue that a bounce is due.

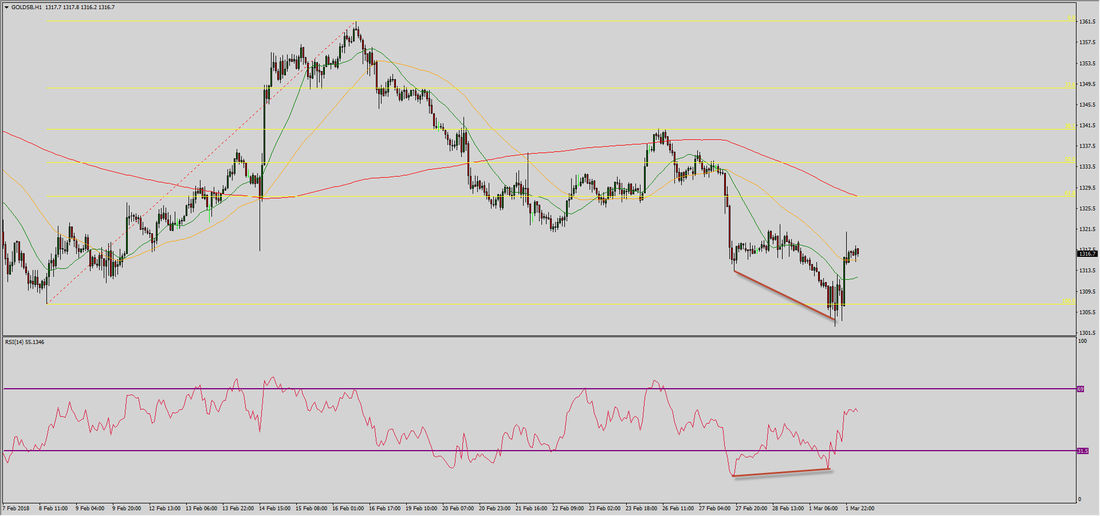

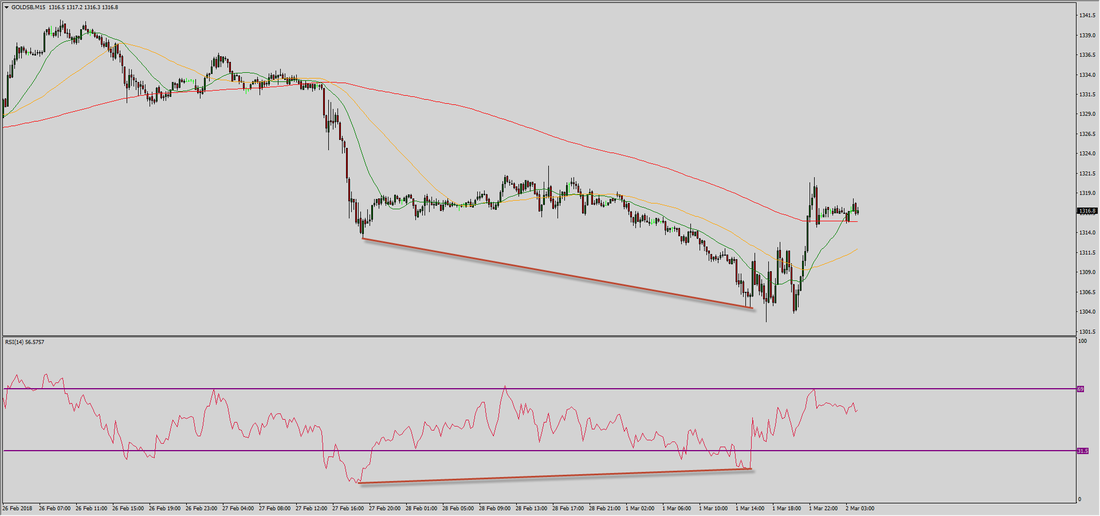

The next two charts are the 5m and 1m

On the 5m below, notice how prior to our entry there is very short-term bullish RSI divergence. Price rallies, but it’s not very strong and soon collapses back to around 1305. This has lifted RSI higher and so sets up the potential for a continuation of that divergence if price makes a lower low. We were waiting for that to form to enter.

Thank you, as always, for following us! We’re currently flat, waiting for our next set up.