Briefly: In our opinion no speculative positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

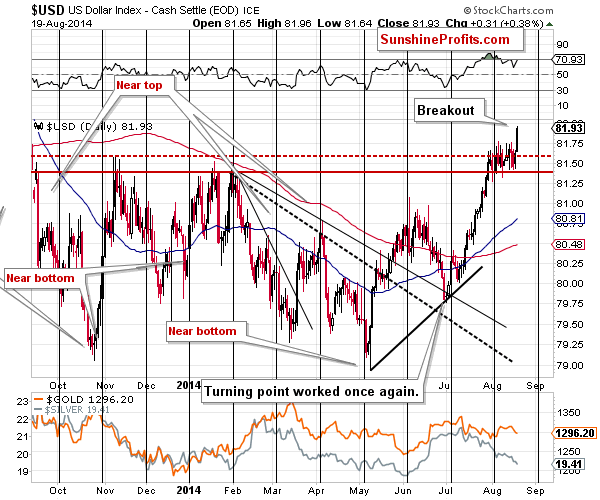

The back-and-forth trading in the USD Index ended as it pierced through the short-term resistance and also above this year’s high. As we have emphasized many times previously, the U.S. currency is after long-, medium- and short-term breakouts so the surprises should be to the upside. Consequently, yesterday’s rally was not unexpected. What was surprising was the lack of real decline in the precious metals sector. Does this mean that the USD rally won’t hurt gold and silver investors? Let’s take a closer look (charts courtesy of http://stockcharts.com).

Please note that the U.S. currency was strong enough not to really decline at the most recent cyclical turning point. Instead, we saw only a small local top that was followed by a consolidation. This type of flat correction is something that characterizes strong uptrends, so it seems quite likely to us that the rally will be continued. The odds will further increase if yesterday’s breakout becomes confirmed.

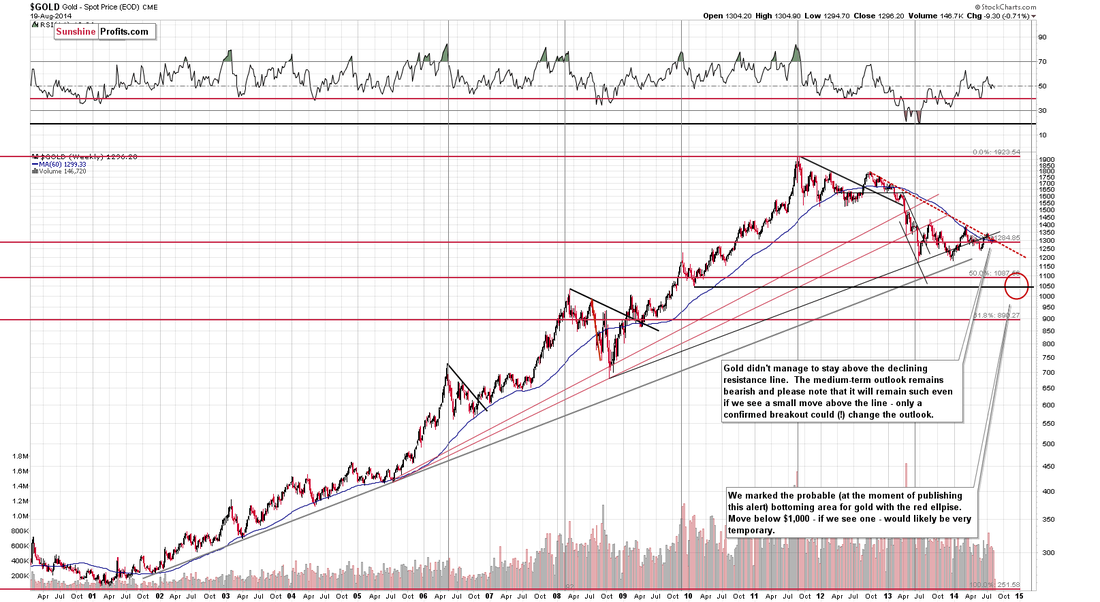

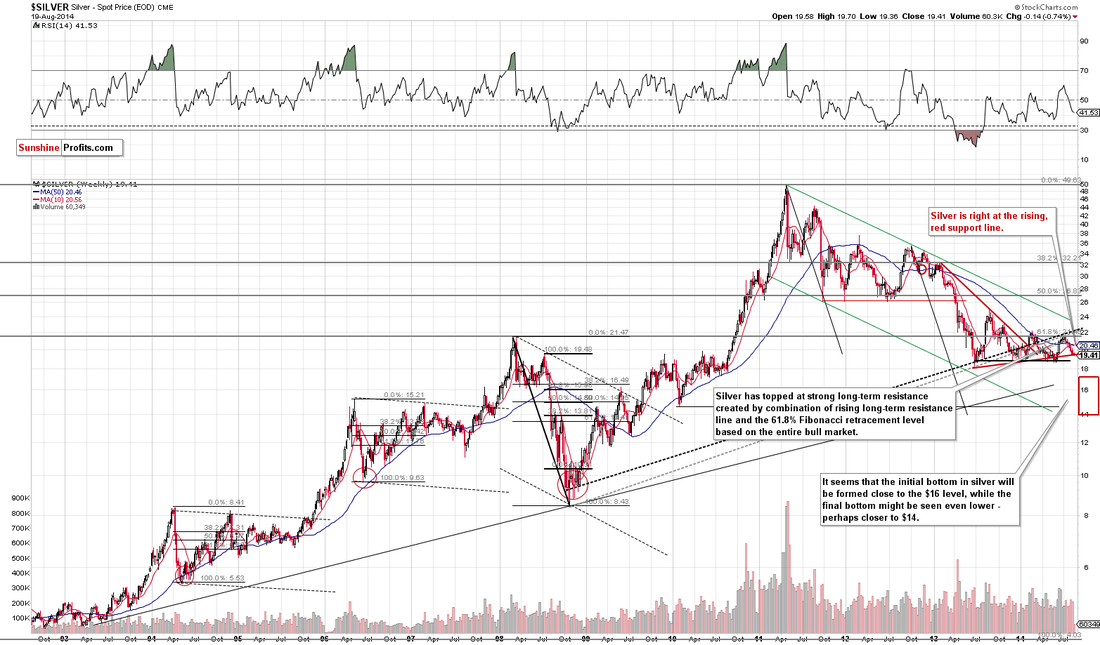

Consequently, the USD Index will likely put bearish pressure on the precious metals sector and once the breakout is confirmed, this will become very likely. Gold and silver are currently at a critical juncture and this pressure might be the thing that “helps metals to decide in which way to go”.

What’s the most likely outcome for the following days? In our opinion we could see a verification of the breakout in the USD Index in the form of a pullback, which would cause a temporary upswing in gold and – especially – silver. Then the rally in the USD would continue and so would the decline in the precious metals sector. Of course, there are no guarantees, but the above is our best guesstimate at the moment.

The above-mentioned corrective upswing in metals could provide a confirmation that the big decline is about to start – for instance if we see silver’s outperformance and/or miners move higher on tiny volume.

Summing up, the situation in the precious metals market still remains too unclear to open any positions in our view, but it seems that we won’t have to wait too long before things clarify and the risk/reward ratio becomes favorable enough to open a trading position.

To summarize:

Trading capital (our opinion): No positions

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.